Sometimes, it’s great to just keep things easy. When it comes to investing, this couldn’t be more true. And while a lot of Canadian investors tend to stick to our side of the border, some of the best investments come from the south side.

But it can be pretty overwhelming to figure out where to invest in U.S. stocks — especially because there are so many of them. That’s why you should keep it simple and go straight to the expert source — namely, Warren Buffett.

Warren Buffett bet

If you want some U.S. stocks and have no idea where to look, then Warren Buffett and his company Berkshire Hathaway are certainly great places to get some ideas. In fact, you could keep it really simple and just see where the investment tycoon has most of his investments.

This is incredibly easy to find. You simply need to look up Berkshire Hathaway 13F filing with the Securities and Exchanges Commission. Luckily for you, I’ve already done that. Here are the three top U.S. stocks Warren Buffett invests in at the time this article was written.

The Big Three

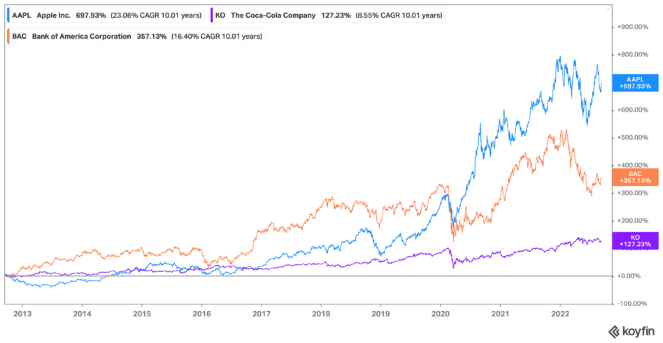

At the top, we have Apple (NASDAQ:AAPL), with Warren Buffett’s Berkshire Hathaway holding a value of US$122.34 billion as of writing. The company remains the go-to name in terms of tech products, including mobile phones, tablets, and more. And shares continue to climb after the release of its latest iPhone 14.

Apple stock when through a stock split back in 2020 and is now a great price at just US$161 per share. What’s even better is, you can now look forward to a dividend — something most tech stocks simply don’t offer.

Next up, we have Bank of America (NYSE:BAC), with a total value of US$31.44 billion as of writing. This bank is a huge deal for investors to consider among U.S. stocks. It currently trades at just 11.06 times earnings due to the market downturn we’re currently experiencing. You can also get a deal on its 2.52% dividend yield.

Finally, there’s Coca-Cola (NYSE:KO). You just cannot do better than Coca Cola in so many ways, and not just for its products. The company is one of the dividend providers that’s hiked its dividend for the last 25 years. It’s no wonder Buffett holds a value worth US$25.16 billion as of writing. And right now, you can lock in a dividend yield at 2.84%.

Keep it simple

Canadian investors looking to get exposure to U.S. stocks can keep it super simple and lock in these for life. Each has been around for decades and remain at the top of their industry. What’s more is that they provide dividends that should only continue to grow in the decades to come.

As the markets recover, these will also be some of the first to get back to pre-fall prices. So, lock in that value you while you can with these three U.S. stocks.