We’re all looking for those amazing passive-income stocks that will sit there feeding us cash again and again. And dividend lovers know the value of having these stocks. It means that even when the market is down, as it is now, you can look forward to some stability.

But the beauty of this passive-income stock I’m going to talk about today is that it delivers cash each and every month. What’s more, it’s been growing that dividend as well as its share price for years. So, let’s talk about it today and how much you could be bringing in this month.

A&W Revenue Royalties Income Fund

A&W Revenue Royalties Income Fund (TSX:AW.UN) is a monthly passive-income stock that currently boasts a 5.18% dividend yield. That comes to $1.86 per year, or $0.155 per share each month. Right now, it trades at $36.75 as of writing, with shares down 4.65% year to date.

You’ll notice that compared to the TSX, that’s not much for this passive-income stock. A&W stock has done quite well, even with the pandemic, market drop, and more weighing on the stock. In fact, during its latest earnings report, A&W stock increased its royalty income by 15.9% year over year, with same-store sales growing 12.2% for the quarter as well.

Long-term growth

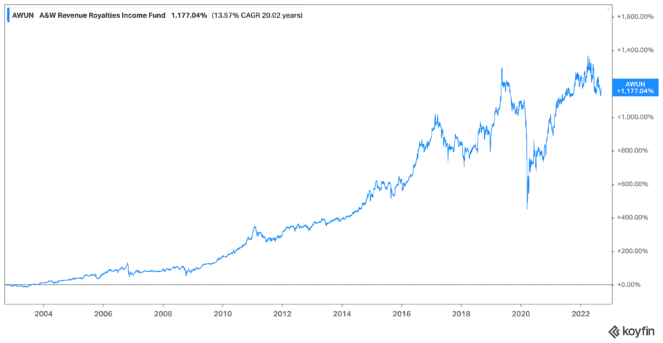

That growth isn’t just recent either. A&W stock has been growing for quite some time for its investors. In the last two decades, shares have grown by 1,177%, which comes to a compound annual growth rate (CAGR) of 13.57%!

For its dividend, the passive-income stock is lower but still just as stable. For that amount, its dividend has grown by a CAGR of 3.03% over the last decade. It’s not as high, surely, but it’s consistent and strong. And that doesn’t look like it’s going to go away anytime soon.

Bringing cash in with this passive-income stock

A&W stock has shown that it can grow even during the darkest of times. It’s remained consistent with both its growth as a passive-income stock, and with its share returns. What’s more, it remains a fair price, trading at just 16.94 times earnings as of writing.

So, let’s say you had about $10,000 to put into this passive-income stock. That would give you 272 shares on the TSX as of writing. That would give you annual income of about $506 right now, which comes to about $42 per month!

Add on to that a potential for the stock to soar out of this market. But let’s say you see it grow by that CAGR of 13.57%. That would mean your $10,000 would turn into $11,357. Add on those dividends, and in a year, you could easily have $11,863 in your portfolio based solely on historical performance.

Bottom line

We could all use some consistency, both in terms of what to expect, and in terms of our finances. By investing $10,000 in A&W stock, you could create $42 each and every month starting right now. What’s more, you could end up with returns of $1,863 by the end of next year.