To be a successful Canadian stock investor, you need patience, an iron stomach, and a very long-time horizon. The problem is that the stock market is liquid and, hence, volatile. Price swings can cause investors to act emotionally and to jump in and out of stocks. This can be a very costly mistake. It is nearly impossible to time a bottom or top to any market or stock.

Think long term to avoid short-term investing pitfalls

The only way to avoid this trap is to buy stocks like you’d buy a private business: for the long term. As Warren Buffett once wisely said, “When we own portions of outstanding businesses with outstanding managements, our favourite holding period is forever.”

When you buy a private business with a great manager, strong products, and a great strategy, you don’t sell it a week or month later just because of bad economic trends. Rather, you hold that business for years, through cycles, until you see its value multiply.

The same applies to investing in Canadian stocks. If you are keen to be an “investor” and not a speculator, here are two top Canadian stocks to hold for two decades or more.

A top Canadian infrastructure stock

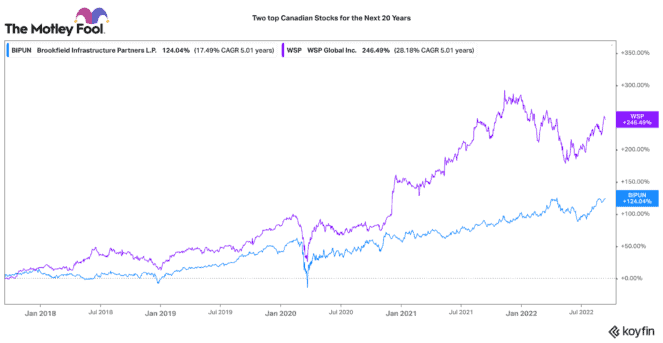

As society grows, there is an ever need for more infrastructure and basic services. That is why Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is a Canadian stock I plan to hold for decades. With businesses that span across railroads, utilities, pipelines, midstream plants, cell towers, and data centres, it has diversified operations that are needed now and likely for years ahead.

It is a perfect staple for any Canadian stock portfolio. While most safe utility and infrastructure stocks are growing by the low single digits, Brookfield targets 12-15% annual growth. 70% of its assets have inflation-indexed contracts, so it is no wonder it can organically grow at such an elevated rate.

Today, it pays a 3.4% dividend. However, it has a great history of growing that dividend by 8-10% a year. Chances are very high your dividend will be much, much higher given a decade of growth ahead.

A top Canadian consulting services stock

Another Canadian stock exposed to the same trends but in a different way is WSP Global (TSX:WSP). It is a leading provider of engineering, design, architecture, and consulting services around the world. This company is unique for its focus on organic and acquisition growth. Since the company started, it has acquired around 190 small and large consulting firms around the globe.

In 2022, it announced three major acquisitions that drastically expand its service breadth in environmental consulting. Clean, reliable, and sustainable infrastructure is a long-term trend companies and governments are focusing on. That bodes very well for WSP’s growth strategy.

WSP has grown earnings per share by an 18.6% compounded annual growth rate (CAGR) for the past five years. Its stock has risen 224%, or by a CAGR of 26%, in that time. With a strong track record of smart growth in the past, there are plenty of reasons to be bullish on this stock over the coming years and decades.