New investors buying into today’s market are likely a bit…confused. They’ve heard for years that investors have been making a tonne of money buying up TSX stocks producing massive growth.

The problem is, those same TSX stocks have now also produced massive losses.

That’s why new investors should absolutely consider keeping it simple. Stop trying to invest in the next big stock. Stop trying to make it complicated and figure out what will make you money the fastest. Instead, keep it simple.

What do I mean by that? Look at blue-chip companies. These TSX stocks have been around for decades and provide investors with substantial historical performance, as well as a secure future. And these are the top three I’d consider today.

BMO

The first of the three TSX stocks I’d choose is Bank of Montreal (TSX:BMO)(NYSE:BMO). That’s due to a few reasons. First off, BMO stock is one of the cheaper options when you’re looking at the Big Six Banks. That being said, it still provides investors with the security of these financial institutions. Even with higher inflation and interest rates, BMO stock has provisions for loan losses as loans come in slower.

But that’s something all bank stocks offer. So why BMO stock? First off, it’s cheap trading at 7.7 times earnings. Second, it has a strong dividend yield of 4.38%, one of the highest of the six. Third, it’s growing consistently. That includes a recent acquisition of the Bank of the West, giving it access to the United States on a larger scale.

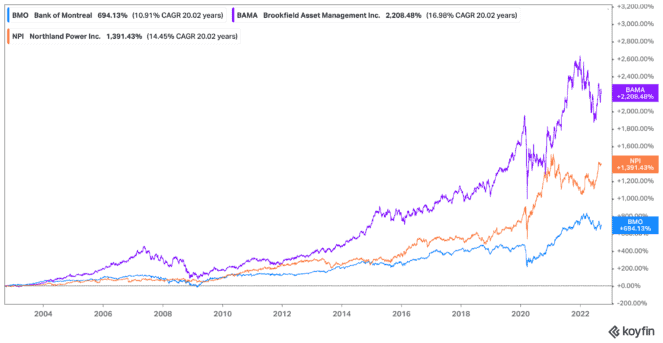

Another bonus is that while shares are down by 3.4% year to date, that’s some of the best performance of the banks right now. And it’s beating most other TSX stocks as well. In the past 20 years, shares have grown 693%! That’s a compound annual growth rate (CAGR) of 10.9%. And that’s security you can’t get from most TSX stocks.

Northland Power

Another strong contender among TSX stocks is Northland Power (TSX:NPI). Northland stock is one of the best performing TSX stocks right now, with shares up an incredible 21% year to date. Yet the company isn’t exactly expensive, trading at 18.4 times earnings.

Investors looking for long-term holds should absolutely consider the stock. Northland stock gives you access to the emerging renewable energy sector. What’s more, it continues to boost its growth through partnerships, most notably in Europe. European countries are moving away from Russian oil to create their own power at home. And this is a trend that will only continue.

As a green power producer that operates around the world, you can gain access to the already stellar 1,393% growth in share price from the last two decades. That’s a CAGR of 14.5%. Plus, you can add on a 2.7% dividend yield as well.

Brookfield Asset Management

There are a bunch of offshoots from the Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) team, and they’re all great. But honestly, I would go straight to the source. Brookfield stock is one of the TSX stocks that’s been around for over 100 years. It has real estate properties in practically every type of category, from energy infrastructure to hotels, all around the world.

Its diversification has created a powerful portfolio that investors can lock into. Now on the surface, shares are down 14% year to date, and that doesn’t look great. It’s clear why, with interest rates and inflation hurting the asset manager. However, long term it’s been an incredible growth stock. Shares of Brookfield stock are up 2,208% in the past two decades. That’s a CAGR of 17% as of writing!

Again, it’s not a value stock, but it’s not expensive either trading at 21.8 times earnings. And again you get a nice 1.13% dividend yield to look forward to. Without a doubt, Brookfield stock is one of the TSX stocks that remains a no brainer.

Bottom line

New investors looking to invest in TSX stocks shouldn’t complicate things. They should stick to the strong performers that have a solid future ahead. In this case, these three fit the bill for long-term returns.