Although it may not seem like it, this is a great time for beginner investors to start investing. Yes, market sentiment is lousy. And yes, it’s a very stressful and uncertain time. But this is giving way to better valuations for the long term. It is, in fact, the best time in a long time to dip your toes into the stock market.

Here are three stocks that can help you begin your successful investing journey.

Source: Getty Images

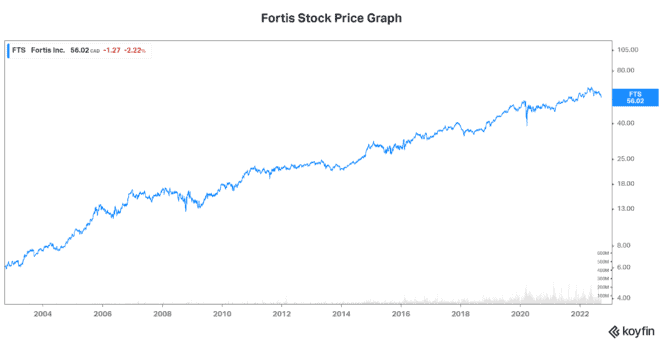

Fortis stock: The defensive income stock that’s perfect for beginner investors

With Fortis (TSX:FTS)(NYSE:FTS) stock, investors get the real deal — consistent long-term growth and predictable earnings. They also get a growing dividend that we can depend on. These are the things that have characterized Fortis for decades. They remain true today, and they will guide you as you begin investing.

It’s true that Fortis stock is thought to be “boring” by some investors. But what they call boring, I call good sense. Because Fortis has been consistently building shareholder value, offering its shareholders long-term wealth creation. It’s been a smooth and steady ride — a journey of wealth creation without drama.

For example, Fortis is well known for its stellar dividend track record. In fact, its dividend has grown for 48 years, without interruption — a pretty enviable track record. This dependability is a function of Fortis’s business as well as its solid operational and financial management. You see, Fortis is a regulated gas and electric utility company. This is the kind of business that’s highly defensive and pretty immune to economic shocks. This means that its downside is relatively limited. It’s pretty safe.

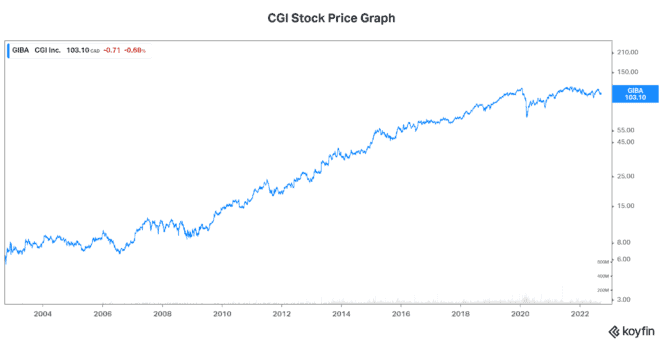

CGI stock: The leading Canadian tech stock

In the interest of diversification, every investor needs exposure to the technology sector. It’s the sector of the future, with tonnes of growth ahead. So, I would be remiss if I left this out of my recommendations for beginner investors. Within this sector, no Canadian tech stock is a better bet than CGI (TSX:GIB.A)(NYSE:GIB).

CGI is a $22 billion information technology and business consulting services firm. The company has grown both organically and via acquisitions. CGI’s acquisition strategy has been implemented with three key standards. First, any acquisition must complement or enhance CGI’s business. Second, any acquisition must have the potential to bring significant synergies. And third, any acquisition must be bought at fair or depressed valuations.

Throughout the years, CGI has delivered on all of this. This is evidenced in the company’s results. In the last five years, CGI’s revenue has grown 12% to over $12 billion in 2021. This has been accompanied by margin improvements and strong cash flow generation. For example, CGI’s adjusted earnings before interest and taxes margin was 16.1% in 2021 versus 14.6% in 2017 — a full 150 basis points higher. Likewise, CGI’s cash flow from operations was $2.1 billion in 2021 versus was $1.4 billion in 2017 — a full 50% higher.

These are all qualities that everyone should look for in a stock. For beginner investors, a discipline that seeks out these qualities will serve you well.

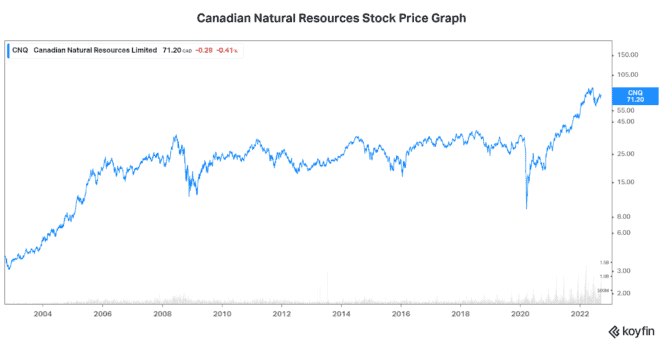

Canadian Natural Resources: An energy stock for beginner investors

Contrary to what has been in the news prior to the pandemic, Canadian oil and gas companies are here to stay. The sad reality is that we cannot function as a society without the energy provided by them. So, I think we’ve moved on to the second-best thing, which is to clean up the energy sector.

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is one of Canada’s top-tier oil and gas companies. It has a market capitalization of $80 billion, a 4.2% dividend yield, and a strong history. In fact, Canadian Natural has been a good investment, even in the difficult times. Its long-life asset base, strong cash flows, and solid balance sheet have made that possible. It’s really the ideal stock for energy exposure.

Today, Canadian Natural is firing on all cylinders. Strong oil and gas prices drove an almost doubling of revenue in its latest quarter. They also drove rapidly increasing dividends and shareholder wealth creation. For example, CNQ stock has rallied 70% in the last year. Also, its dividend has increased 178% in the last five years.