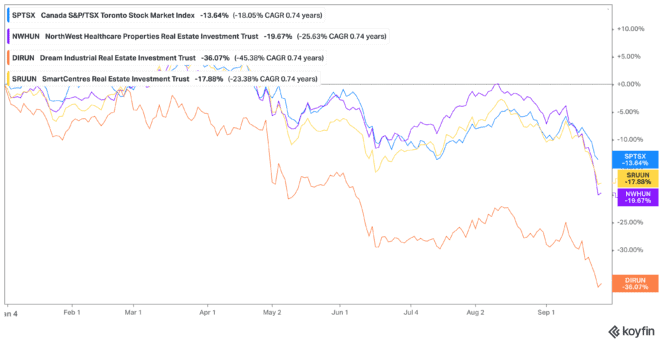

Dividend stocks have become incredibly popular these days with the market downturn. And it’s clear why. The TSX today continues to drop, even surpassing 52-week lows. As of writing, it’s down 14% year to date, and 17% from 52-week highs.

Yet if you’re a long-term investor, then now is the time to pick up passive income dividend stocks. You’re getting a huge deal on some of the best names out there. In fact, some now offer dividend yields surpassing 6%! And here are the three I’d buy now, before the market recovers.

NorthWest REIT: 7.18%

NorthWest Healthcare Properties REIT (TSX:NWH.UN) is the first one I would consider. The real estate investment trust (REIT) is a strong option as it invests in the stable field of healthcare. We saw just how stable it was during the pandemic. And it was during this time that NorthWest’s properties chose to renew lease agreements, offering stability with an average lease of 14.1 years.

NorthWest has been expanding as well since coming on the market. So while it hasn’t increased its dividend, it’s one of the dividend stocks that has seen record revenue. Even still, NWH.UN is a substantial deal, along with an ultra-high dividend yield.

NorthWest stock trades at just 6 times earnings with shares down 20% year to date. It offers a substantial 7.18% dividend yield, which comes in at $0.80 per share annually. If you were to invest $5,000 today, that would bring in annual dividends of $376. That’s compared to $277 at 52-week highs.

Dream Industrial REIT: 6.64%

Dream Industrial REIT (TSX:DIR.UN) is the next I would consider. This stock has also fallen to incredible lows in the past few weeks. Nonetheless, it’s a strong long-term hold among dividend stocks, as industrial properties are sorely needed. In fact, it looks like this industrial arm is holding up the parent asset manager at the moment, with industrial revenue climbing through more acquisitions.

E-commerce may be down now, but it won’t be forever. So when consumers start spending once more, dividend stocks in the e-commerce sector will start soaring. So right now, you can lock in a huge deal, with a huge dividend as well.

Dream Industrial stock trades at just 2.8 times earnings, with shares down a whopping 36% year to date. You can pick it up today with a 6.64% dividend yield, which comes to $0.70 per share annually. That $5,000 would get you $329 per year today in passive income, compared to $199 at 52-week highs.

SmartCentres REIT: 7.1%

Finally, SmartCentres REIT (TSX:SRU.UN) has proven to be a strong choice as well among dividend stocks. It’s now one of Canada’s largest fully integrated REITs, boasting a 97.4% occupancy rate. And right now, the company is in expansion mode. Rather than focusing only on its commercial properties, it’s now moving to mixed use.

This mixed use will include residential and retirement residences, sure. But it will also include industrial and storage properties as well. With these low-maintenance properties, company revenue can surge for a small investment.

Yet again, it trades at an incredible 3.9 times earnings, with shares down 18% year to date. Today, investors can lock in a 7.1% dividend yield, paying out $1.85 per share annually. So if you were to put $5,000 in this stock, it would bring in $366 with your other dividend stocks. That’s compared to $276 at 52-week highs.

Bottom line

These prices aren’t going to last forever, and neither is the stability you can gain from these dividend stocks. Shares will rise again, but these dividends aren’t likely to climb as fast. So I would lock in this passive income at these prices before they’re gone!