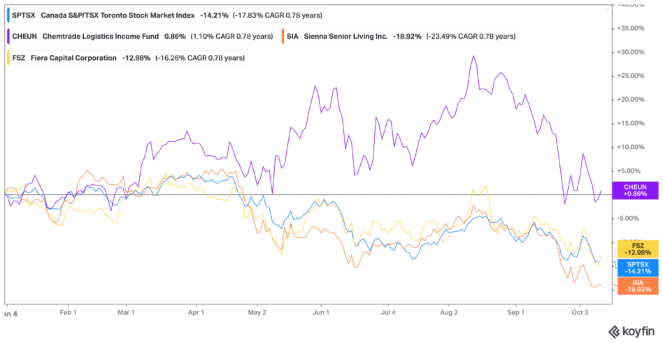

The TSX fell to 52-week lows this week, down 14.21% year-to-date and 11% in the last year. And the market could still fall further, according to economists. This comes as U.S. inflation data shows consumers are still spending, and inflation is still rising along with interest rates. Yet more people are losing their jobs in this pre-recession storm.

However, if you’re waiting for a market bottom: don’t. It’s not about timing the market for gains. It’s about time in the market. And this has been proven time and time again. This is why buying potential growth stocks at low prices isn’t the best short-term strategy. No, it’s buying dividend stocks with high yields to help you weather the storm.

Today, I’m going to cover the top three stocks to consider with dividend yields above 8%.

Chemtrade

One of the highest dividend yields out there is from Chemtrade Logistics Income Fund (TSX:CHE.UN) which currently offers a juicy yield of 8.72% for investors. The company provides necessary industrial chemicals that will remain relevant and needed even during market downturns.

The issue here is that Chemtrade is usually a cyclical stock. It therefore does well when the market drops but tends to flip when the market recovers. Even still, the stock has fallen off a cliff lately. Shares are down 13% in the last month alone but are still about where they were at the beginning of January.

When this bump in the road is over, it’s likely investors will continue flooding Chemtrade stock with their cash for the passive income. So, I’d buy now before it recovers again.

Sienna Senior Living

Retirement homes, long-term care, memory care, it’s all a necessity right now. And that necessity is growing exponentially with the aging of baby boomers. Once they hit 80, that’s when recurrent health problems can exasperate, and when retirement and long-term care will become necessary.

Given this, Sienna Senior Living (TSX:SIA) is a strong option for investors to consider. Sienna stock has a dividend yield of 8.14% as of this writing. It continues to expand its portfolio to offer every type of senior living care, beyond just retirement residences. Plus, shares are down almost 19% year-to-date as of this writing.

This is not market-beating performance. However, if you’re thinking long-term, Sienna stock is a strong bet. In the next few decades, it will continue to be a much-needed property manager, leading to significant boosts in returns as well as dividend income. So, I would certainly buy it at these levels.

Fiera

Finally, Fiera Capital (TSX:FSZ) is another strong choice for those seeking returns as well as passive income. Fiera is an asset management firm that offers a wide range of traditional and alternative investment solutions, and delivers investment management capabilities to institutional, private wealth, and retail clients.

The stock is one of just a few dividend stocks with an ultra-high yield of 10.25%! That dividend has risen higher and higher over the years thanks to a strong management team that’s been able to find value and growth stocks set to soar.

During its latest quarter, Fiera stock did see revenue, assets under management, and adjusted net earnings fall. But this was par for the course considering the market downturn. Management took action, bringing down debt and increasing sales as well as private wealth revenue. To assist with this, it bought back shares for cancellation and was able to remain a strong and healthy company to invest in.

Fiera stock has been around for decades and will likely be around for decades more as a high-dividend provider. It’s one of the few dividend stocks that’s been able to retain such an ultra-high yield which is up 130% in the last two decades, even after this fall. So, with shares down 13% year-to-date, it’s a great time to buy this stock at a significant discount.