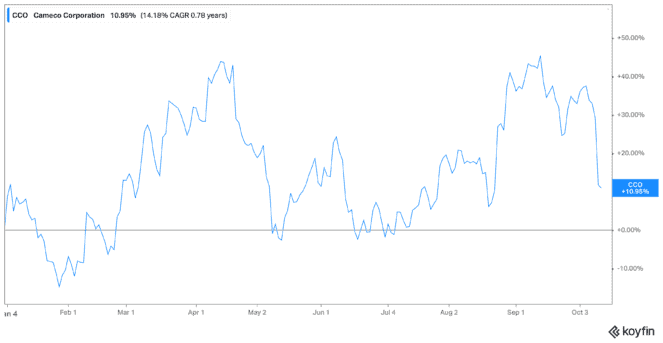

Cameco (TSX:CCO) has been a volatile stock over the past few years. And I’m certainly not saying that’s suddenly changed overnight. However, with current market volatility taken into consideration, here’s why I’m more excited than ever about Cameco stock.

The meme stock craze is passed

While it may come back in the future, as of writing, the meme stock phase for Cameco stock is currently passed. We don’t have to worry at present about investors feeding the stock only to sell it. If that happens again one day, then sure, sell at enormous highs! But for now, this has reduced volatility to normal levels.

And don’t get me wrong; those levels are still high. Cameco stock is currently up about 11% year to date. However, it’s by far lower than where it was during the meme stock phase. In fact, it’s far lower than it was just a month ago. Shares of Cameco stock are now down by 22% in the last month alone.

Their loss is your gain

Shares of Cameco stock mainly fell over the last week after announcing it would take a stake in a new electric company. This means it’s going to be putting attention onto more than just uranium. At the outset, this may not be the smartest idea.

That’s because the world desperately needs uranium, so you would think the company would want to invest itself more into this area. After all, Russian sanctions has left the world with even less uranium than it had before. And uranium prices are climbing because of it. So, why not invest in uranium companies instead?

The answer is simple: longevity. Cameco stock is looking for ways to diversify its investments for long-term renewable energy planning. And that makes sense, which is what I want to cover next.

For now, don’t think long term

Here’s the thing: I’m excited about Cameco stock as a short-term investment. Let me be clear: by short term, I mean like three to five years, not decades. In the next few years, the world is going to sorely need these uranium companies that power nuclear reactors. And Cameco stock is one of the world’s largest.

With higher prices of uranium comes higher profits, putting it in a strong position for growth. So, after this recent fall is done, investors are likely going to come flooding back.

That being said, as of now, one investment in an electric company does not a solid profile make. With that in mind, I’d plan on waiting for ultra-high share prices, and selling once I meet my goals for returns.

Bottom line

For now, Cameco stock is a great buy. Shares are down 22% in the last month, and it remains in a strong financial position with just 22.71% of equity need to cover all debts. It continues to see earnings rise and is using that cash to diversify. So, if I were you, I’d use this recent downturn to your advantage and invest in Cameco stock before it recovers.