Canadian investors have moved their attention to dividend stocks during this market downturn. It’s clear to see why. You can look forward to passive income each month, and there are some phenomenal options out there for high dividend yields.

However, not all of these dividend stocks are safe ones. What does safety mean? You need to make sure these dividend stocks can continue to pay out those high yields. Today, I’ll be looking at three dividend stocks that can do just that.

Slate Grocery REIT

First up, I would look to Slate Grocery REIT (TSX:SGR.UN). This real estate investment trust (REIT) focuses on grocery chains located in the United States. It has continued to expand during this downturn, thanks to remaining a necessary service throughout the pandemic.

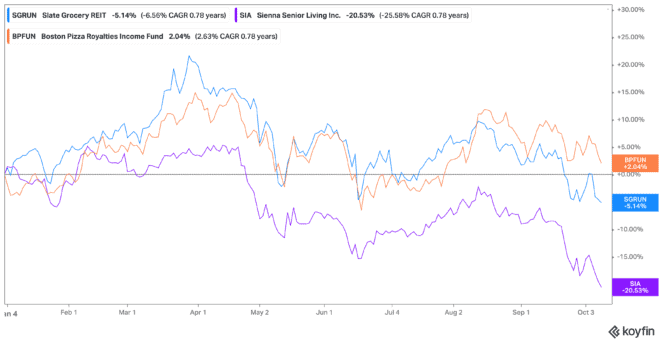

Slate now offers an insanely high 9.24% dividend yield for investors. This comes to a dividend of $1.20, paid out on a monthly basis. And it’s only climbed higher, as it’s down by 5.44% year to date.

But comparatively, that’s quite excellent. The TSX is down 12.44% as of writing. So, you can look forward to a quicker rebound from this stock. Furthermore, it offers safety, trading at 5.86 times earnings and 0.85 times book value.

Sienna Senior Living

Next, we have Sienna Senior Living (TSX:SIA), which invests of course in senior living properties. This property manager offers every type of senior living scenario under the sun. Whether it’s retirement residences, long-term care, or even memory care, the company offers it. And those needing this care is only rising in Canada, as baby boomers continue to age closer to their 80s.

This is why now is an excellent time to consider this top stock among your dividend stocks. It offers a substantial 8.14% dividend yield as of writing, trading at a fair 32.49 times earnings. Shares are down 21% year to date, but again, if you’re a long-term investor, this shouldn’t frighten you.

That’s because Sienna has a decade of strong performance behind it. Shares are still up 56% in that time, even after these recent downturns. So, if you’re looking for long-term stable growth with passive income, it’s a dividend stock for you.

Boston Pizza

Finally, Boston Pizza Royalties Income Fund (TSX:BPF.UN) is last but certainly not least. It offers an ultra-high dividend yield at 7.85%, as of writing. Furthermore, it too is cheap trading at just 10.89 times earnings. But what makes it so good?

First off, the company is doing well — so well, in fact, that it actually increase its dividend to $0.10 per month during its last quarter result. That’s during some of the worst times on the market. Plus, shares are actually up 2% year to date. Now, earnings are just around the corner. So, we could see the company reaffirm this dividend once more.

As revenue continues to beat out estimates, and pandemic restrictions gone to the wayside, it looks like Boston Pizza will be one of the dividend stocks to keep doing well — especially because, during a downturn, Canadians look to cheaper dining-out options. So, don’t forget to consider this stock when looking at dividend stocks.