Passive income is the income stream that comes when we get our money working for us. It sets us up for freedom, both before and after retirement. While setting up a passive-income stream requires dedication and sacrifice, the reward is more than worth it. Today, there are plenty of good opportunities to help us get started. After all, many of the best dividend stocks have been hit recently. This provides us with a good entry point.

Without further ado, here is the best energy dividend stock to buy for passive income.

A “safe” energy stock

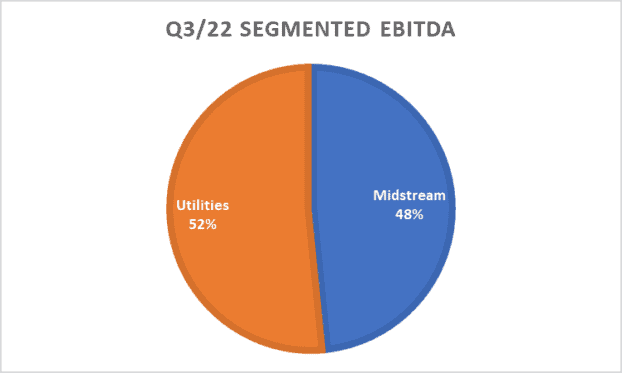

While we can classify AltaGas (TSX:ALA) as an energy stock, roughly half of its EBITDA (earnings before interest, taxes, depreciation, and amortization) is from its utilities segment. This segment is regulated. It’s also very insensitive to the broader economy. People need energy to heat their homes and power their lives. This results in a very defensive income stream for AltaGas that’s highly predictable. It means that AltaGas stock and its dividend have an extra level of security and predictability.

So, along with the typical predictability that comes with the utilities business, AltaGas has exposure to the strong growth offered by its energy business. The latest quarter, once again, showed record demand for volumes out of AltaGas’s export terminals. This is being driven by Asia and other parts of the world, who are looking for energy supply. Moreover, the cash flow generated by these volumes is becoming increasingly predictable as well. In 2023, AltaGas’s volumes are largely hedged. Thus, these volumes will provide another source of predictable and growing cash flows.

AltaGas stock has a long runway for growth, supporting passive income well into the future

In the last two years, AltaGas has increased its dividend by more than 10%. In addition, its stock price has risen 31%. But this is just the beginning. AltaGas has only recently transformed into the company that it is today, and the benefits are only beginning to accrue.

Back in 2017, AltaGas risked a lot with its $8.4 billion debt-financed acquisition of WGL Holdings Inc., a diversified U.S. energy infrastructure company. The merger would allow AltaGas to leverage each company’s strengths in the utilities, midstream, and clean power industries. All these years later, we are seeing this come to fruition.

Last quarter, AltaGas reported strong results from its utilities segment — an almost 13% increase in EBITDA. In its midstream segment, AltaGas reported continued strong demand for its liquified petroleum gas exports. In fact, this strong demand drove record global export volumes. Even after the quarter ended, volumes continued to beat expectations. Management is expecting average volumes of 98,000 barrels a day in the fourth quarter of this year, which is up from zero only three years ago.

There’s no doubt that the ramp up has been rapid. Global demand for Canadian natural gas has only begun. We can expect this strength to continue, as the world continues to crave cheap, comparatively clean, and reliable energy from Canada.

A dividend stock worth owning

So, we’ve seen that AltaGas has a pretty predictable income stream. We’ve also seen that there’s some good growth as well. This is driving my assertion that AltaGas is the best energy dividend stock for passive income.

You see, AltaGas is yielding a very generous 4.5%. Also, it’s trading at book value and at a price-to-cash flow multiple of a mere 8.8 times. The industry’s average valuations are significantly higher, despite the fact that AltaGas has a better cash flow growth and returns profile.

Motley Fool: The bottom line

The best energy dividend stock for passive income is one that provides investors with safety and predictability as well as growth. It also offers investors a long-term security blanket, as we can rest assured that AltaGas’s infrastructure will be needed for decades to come.