Like it or not, bear markets happen. They bring stress and uncertainty but they also bring with them a very clear silver lining – the opportunity to snatch up some quality stocks at discount valuations. It’s not easy, but if you can muster up the discipline and strength, bear market purchases might be some of your best buys.

Buying during a bear market – not just a frightful event

The one thing that economists and policymakers hate most are bear markets. They destroy value, they cause stress, and they give us a feeling of uncertainty.

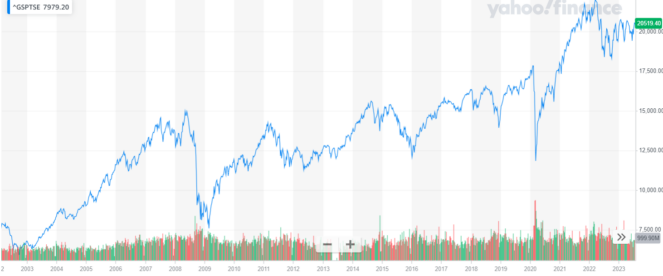

But if you remember to look at the big, long-term perspective of a bear market, this is where it gets interesting. Let’s take the 2008/09 credit crisis as an example. During that time period, I remember the feeling of doom and fear. It’s certainly not easy to watch our savings dwindle at the whim of the stock market. The TSX price graph below gives us perspective.

The market fell 46% from June 2008 to March 2009. That’s a huge decline that understandably left investors reeling. But now look at what happened after that. Basically, investors who bought during that time of crisis put up a very solid performance.

In the same graph, we can also see the dip that happened during the pandemic. The same feelings took over the market during that bearish turn. Yet, those who bought at that time also did really well. From a long-term standpoint, the market has kept rising, fuelled by continued long-term growth and progress.

What you buy makes all the difference

In a bear market, history shows us that we can be confident that the economy will return to growth and the market will recover. Therefore, the only thing left for us to do is to ensure that we choose the right stocks to buy during these times of uncertainty.

Stocks like Fortis Inc. (TSX:FTS) come to mind. Fortis is a regulated utility that provides energy to its customers in North America. There will never be a time when we don’t need energy. And Fortis is firmly entrenched as one of the prime suppliers. With 50 years of dividend increases as evidence of the company’s resilience and predictability, Fortis stock is a prime candidate to buy in a bearish turn.

Similarly, another company that has proven itself to be resilient and essential is BCE Inc. (TSX:BCE). BCE is Canada’s largest telecom services company. It boasts an unmatched network, with the fastest and farthest-reaching broadband internet connection. BCE stock always gets hit like the rest of them in a bear market, but it’s another one that we can be confident will remain standing for better days ahead.

What not to buy in a bearish turn

Just as important, we also need to know which stocks we should avoid in these uncertain times. This long list includes companies that have high debt loads without secure revenue and cash flows. It also includes those with losses, non-essential products, and those that are too small. All of these factors can result in things getting ugly quick in hard times.

The point is that we obviously want to buy the stocks of those companies that have a very high likelihood of surviving the bear crisis.

The bottom line

So, take comfort in the fact that bear markets end. Instead of panicking when they come, make a list of strong companies to buy when their valuations get hit. This way, you will create long-term value despite the short-term chaos. And remember, as long as you hold these companies and even buy them during a bearish turn, and you don’t sell, the losses you see on the screen are just that – losses on a screen.