Passive income – it’s what many of us are striving for. It would make our lives easier, freer, and generally better. It usually takes some time investing in order to build up a passive income stream that can make a difference. But whether you’re just starting out, or you’ve already something built up, today I have a TSX stock for you that can accelerate your plans.

Passive income is for everyone

When investing, people have a few goals. The first one is to make it rich quickly and easily. While this is an understandable goal, it’s difficult to achieve, as the kind of returns required also involve a lot of risk.

Another goal that people can have when investing is to replace their income, or generate passive income. Passive income is regular income that is earned without being employed. In other words, it’s money that you earn by simply being. Because your income stream is not dependent on your work – it’s passive.

Passive income usually comes from an investment in a financial asset, such as bonds, real estate or stocks. It can be from sources such as interest income, dividend income, rental income, or royalties. Today, dividend yields are high so the stock market is a good place to look. It simply means that turning to stocks for passive income is a very good idea.

BCE: A telecom stock yielding 7%

The first thing to look for when choosing your source of passive income is its reliability. We should have a high degree of comfort in the dividend and the company backing it up. We should also think about whether the dividend is likely to keep up with inflation. So, let’s take a look.

BCE Inc. (TSX:BCE) is Canada’s largest telecom services company. Its business is relatively steady and predictable, with ample cash flows and a strong competitive position. All of these things ensure dividend reliability and consistency.

In fact, BCE has consistently paid a dividend for decades. And, this dividend has consistently grown – it has increased 223% since the year 2000. Looking ahead, the company continues to be committed to dividend growth. Earlier this year, a 5.2% dividend increase was implemented, making it the fifteenth year that it was increased by 5% or more.

Why BCE?

There are many stocks in the stock market to choose from. However, TSX stocks like BCE are ideal candidates for passive income. I’ve already mentioned its dividend, now I’ll briefly touch upon its position in the telecom industry.

BCE boasts an unmatched network, with the fastest and farthest-reaching broadband internet connection. Also, BCE has a leading position in fibre optics, which is expanding rapidly, as well as in 5G, which is on track to grow to 85% penetration in Canada. In the third quarter of 2023, BCE reported strong free cash flow of $754 million, 17% higher than last year and an illustration of its financial strength.

How to generate $5,000 in passive income with BCE stock

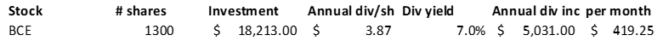

Investing $18,200 in BCE stock today will give you $5,031 in annual passive income. That’s a significant income stream and one that history tells us you can rely on. Also, it’s likely to continue to grow, as more Canadians are connected, and as BCE continues to grow.