I’ve written about Enbridge (TSX:ENB) a lot over the years. This is because of its exceptionally high dividend yield and its predictable business, both of which make Enbridge stock a natural place to turn for passive income.

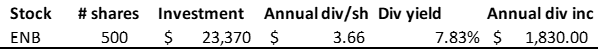

In this article, I’d like to take a moment to highlight how you can generate $1,830 per year by investing in Enbridge stock today.

Why Enbridge?

Well, the answer boils down to the company’s reliable and growing cash flow. In fact, Enbridge expects its distributable cash flow to increase to $11 to $11.8 billion in 2024. This is 45-55% higher than distributable cash flow of $7.6 billion in 2018. And it equates to a compound annual growth rate (CAGR) in the range of 6.4% to 7.6%.

On top of this, Enbridge’s per-share metrics have also been good. This is a very important point for shareholders, as we want to avoid dilution. For example, distributable cash flow per share is expected to be between $5.40 and $5.80 in 2024. This compares to $4.40 in 2018, and it equates to a six-year CAGR of between 3.5% and 4.7%.

Finally, dividends at Enbridge have been growing, safe, and reliable. In fact, Enbridge has 29 consecutive years of dividend increases under its belt. Since the year 2000, Enbridge’s annual dividend per share has increased over 1,000% to the current $3.66. That’s a very healthy 11% CAGR.

Taking advantage of Enbridge’s 7.85% dividend yield

One thing that strikes me with Enbridge is the fact that it’s yielding 7.85%. I personally think that this type of high yield is not expected for a high-quality company like Enbridge. I understand the risk factors and the perceptions that brought us here. Yet, I believe that there’s a mispricing of significant proportions.

You see, despite the issues surrounding fossil fuels and high interest rates, Enbridge remains a consistent performer, as I’ve touched upon in the prior section. Also, the company provides North America with the essential energy needed to power work and home, and this demand is increasing as the population increases.

So, at this level, Enbridge stock is very interesting. This is a function of the company’s great potential to help investors generate passive income as well as the company’s record of generating consistent, steady growth.

Investing for dividends and passive income

We’ve determined the value of Enbridge stock. We’ve also determined that a 7.85% dividend yield usually comes at a higher price, that is, with more risk. Enbridge stock is, therefore, in a sweet spot, offering a juicy yield with a lower commensurate risk.

This is why I recommend buying Enbridge for passive income. In the chart below, you can see that if you buy a mere 500 shares of Enbridge stock, you will generate $1,830 in annual dividend income. This would require an investment of $23,370. With a growing and secure dividend, this investment will surely be worth it in both the short run and the long run.

The bottom line

In closing, I think that investing in Enbridge stock is a good move for passive-income investors to make. No matter how much money you have available, gaining exposure to this high-yield stock will likely be a good, profitable decision.