In the realm of income investing, few things tempt like a hefty dividend yield. And with its 7.8% dividend yield following a recent 3.1% dividend raise, BCE (TSX:BCE) stock might seem like the holy grail for income-hungry investors. After all, the blue-chip stock boasts the highest dividend yield in the Canadian telecom industry, offering a seemingly effortless stream of passive income.

But hold on before you load up on BCE stock for its juicy dividend. The $46.3 billion telecoms and media giant’s dividend is increasingly risky. While the allure of a 7.8% payout is undeniable, the reality behind BCE’s generosity paints a slightly concerning picture that coincided with the stock’s pullback over the past five years.

An analysis of BCE dividend and its power to generate immense returns in your portfolio unveils the lurking dangers masked by its sweetness, and ultimately answers the burning question: Is BCE truly the best high-yield dividend stock for you?

The allure of BCE’s 7.8% dividend yield: It could double your money in 9.2 years

BCE’s high 7.8% dividend yield for 2024 surpasses TELUS’s 6.3%, and Rogers Communications’s 3.3% yield offerings by significant margins. BCE stock’s dividend could help you double your money in under a decade, even if its stock price goes nowhere during the next decade.

One simple rule of thumb, the Rule of 72 estimates that it takes 9.23 years of reinvesting BCE’s quarterly dividends to double your investment. The company has raised dividends for 16 consecutive years now, any further dividend increases in the future will elevate the yield on your cost, and accelerate the rate at which income investors grow their money.

If you are a long-term-oriented investor who believes BCE stock price will hold within current levels, you could confidently load up shares, enroll in BCE’s dividend reinvestment plan (DRP), and let the quarterly payouts roll into new shares, and compound your returns.

However, there’s a growing risk that may stall dividend growth rates, and potentially drag the stock down. The bloated dividend is increasingly unsustainable.

Investor beware: BCE’s dividend is increasingly unsustainable

The general attribute of Canadian telecom stocks like BCE is that they are relatively low-risk investments with resilient, largely visible recurring cash flows that are usually anticyclical and resilient through recessions. However, BCE’s growing business and regulatory risks may threaten its dividend, or at least slow its growth rate significantly over the next few years. The company’s payout already appears unsustainable at current levels.

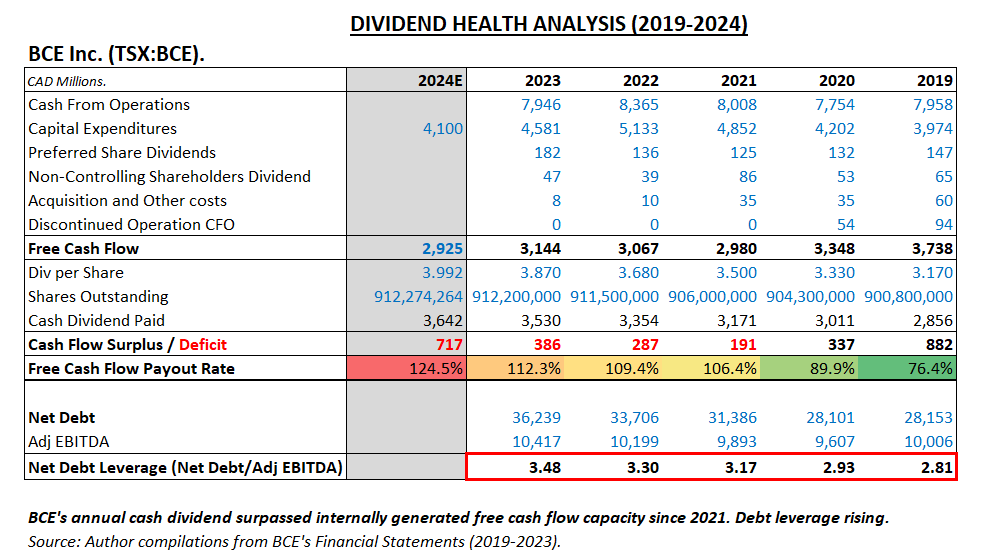

The best measure of dividend safety and sustainability is free cash flow. Free cash flow is the residual cash generated by a business’s operations after capital expenditures. For BCE, free cash flow available for common share dividends includes adjustments for dividends to preferred shareholders and non-controlling entities, while adding back acquisitions-related costs.

Since 2021, BCE’s dividends aren’t fully covered by internally generated cash flow anymore, creating a deficit that debt fills up – as shown in the table above.

The company’s aggressive capital investment drive and generous annual dividend raises both seem unsustainable now. According to management’s guidance, with a $4.1 billion capital budget and projected free cash flow dropping to a range between $2.8 billion and $3 billion for 2024, dividends could create a $717 million deficit in internally generated cash flow.

A free cash flow payout rate of 124.5% for 2024 is not sustainable.

BCE will likely significantly slow down its dividend growth rates in the future or cut its expenditure budgets. Otherwise, investors should accept creeping leverage ratios and increased debt risks. As a starting point, the company’s 3.1% dividend raise for 2024 is far below its usual 5% raises averaged during a prior 15-year dividend growth streak up to 2023.

Investor takeaway

BCE could maintain its current Canadian dividend aristocrat status, aggressively cut costs, further reduce its workforce, and decrease capital expenditures in the short term. Income investors can still benefit from the company’s generous dividend policy.

That said, an unfavourable regulatory environment that forced the company to open up its extensive multi-billion fibre network to small competitors at wholesale prices could continue to weigh on the stock’s value. Recent regulatory developments removed some of BCE’s competitive moats, slowed its revenue growth potential and negatively impacted the company’s returns on invested capital. If the dividend is not at risk, investors may expect potentially negative capital returns as leverage grows.