Tired of the market frenzy? Seeking stable, recession-proof stocks for your portfolio? Consider investing in Canadian food giants Metro (TSX:MRU) and Loblaw Companies (TSX:L). Both offer low-beta stability and consistent dividends, but which is the better food stock to buy for 2024?

While many individuals endlessly chase the latest tech trends, smart investors know the timeless value of defensive stocks. These steady performers, like grocery chains, provide essential goods regardless of economic conditions. But with both Metro and Loblaw boasting strong track records, choosing the right stock can be tricky.

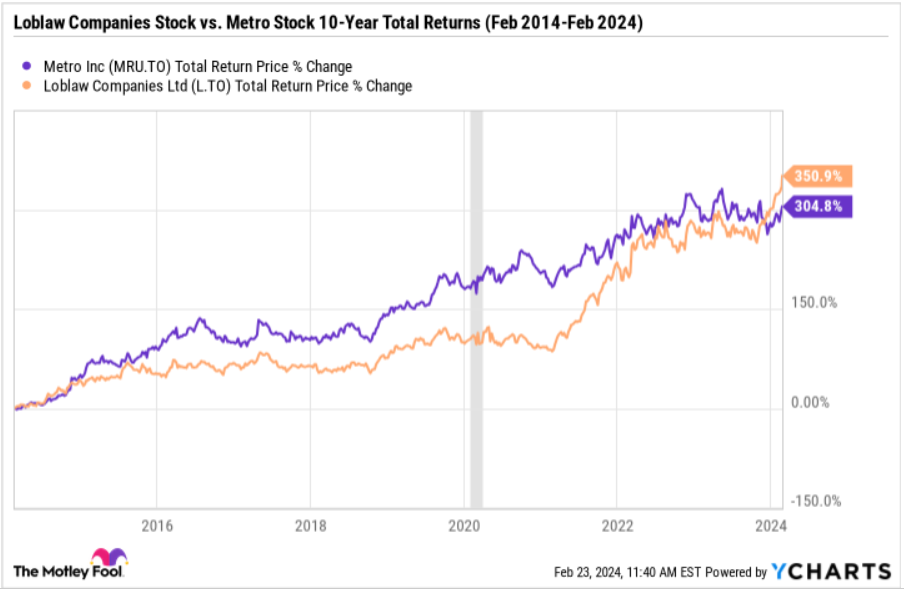

Past performance shows Loblaw’s impressive 142% total return compared more favourably to Metro’s 59.4% over the past five years. However, future results are never guaranteed. Let’s delve deeper and uncover which consumer staples stock offers the potential for steady growth and outperformance in 2024.

The case for buying Metro stock

Metro is a $16.6 billion discount food and drug retail stock whose business did well going into 2024. Quarterly revenue grew 6.5% during the last quarter of calendar year 2023 to nearly $5 billion. Strong same-store-sales growth rates of 6.1% and 3.9% at food service outlets and pharmacies, respectively, gave the impression of a defensive business that’s coming out of an inflationary bout all intact, providing strong backing for Metro stock price in 2024.

Most noteworthy, Metro’s shareholder-friendly capital budgeting policies could deliver good returns to shareholders. The company recently raised its quarterly dividend by 10.7% year over year in January. The latest payout yields a respectable 1.8% annually.

The company is aggressively repurchasing its stock. Metro has authorization to repurchase up to 7,000,000 common shares between November 25, 2023, and November 24, 2024. By January 19 this year, the company had already bought 1,675,000 shares or 23.9% of its current stock repurchase quota. Management is committed to reducing outstanding shares, and the remaining shareholders will hold more equity claims in the recession-proof stock.

Investors beware, Metro anticipates reporting flat to lower earnings for the Fiscal Year 2024 following the launches of its automated distribution centre and an automated fresh produce plant. The launches introduce temporary duplication costs and higher depreciation costs. Looking ahead, the investments should drive long-term profitability growth as the company executes towards a target 8% to 10% net earnings growth rate over the medium to long term.

Any low-earnings-induced dips in Metro stock price in 2024 could be lucrative buying opportunities as the business suffers short-term pain for long-term gain.

Why buy Loblaw Companies stock instead?

Loblaw Companies stock has been the better-performing Canadian food stock lately. If your trading and investment strategy is momentum-based, then Loblaw stock could be the better defensive stock to buy. Shares recovered from a near decade of underperformance to beat Metro stock’s slow and steady gains since 2021.

The $44.2 billion company is consolidating its position as the country’s largest food and drug retailer. It opened 31 new NoFrills and Maxi stores in 2023 to expand its retail footprint, and grew revenue and earnings at 3.7% and 2.3% year-over year, respectively, to $14.5 billion and $541 million during the most recent quarter. Adjusted earnings per share surged by 13.6% year over year, reflecting strong profitability growth.

Loblaw’s roll out of new pharmacy-based clinics should be a new growth driver in the near term. Pharmacy and healthcare services’ same store sales growth of 8% during the most recent quarter shows positive momentum and added a layer of profitable revenue to the operation.

Most noteworthy, Loblaw is repurchasing its common stock at a more aggressive rate. During the past five years, Loblaw reduced its average outstanding share count by 14.3%. Metro stock’s share count fell by a lower 10.9% during the same period. Lower share counts lift Loblaw stock higher, at a faster rate.

Looking ahead, Loblaw anticipates growing its earnings faster than sales in 2024 as it continues to invest in its store network and distribution centers. Management’s latest guidance for net earnings per share growth “in the high single-digits” for 2024 seems more bullish than Metro’s flat guidance for Fiscal Year 2024.

That said, Loblaw’s dividend growth rates seem comparable to Metro’s over the past five years. However, due to stronger stock price performance, the former’s 1.3% dividend yield is lower than the latter’s 1.8%. Regardless, Metro’s yield edge may not be enough to make it more attractive than Loblaw stock today.