Thanks to exchange-traded funds (ETFs), even with just $100, you can obtain a complete investment portfolio as a beginner.

Each ETF acts as a “basket” of stocks—they purchase and hold various companies according to specific rules, often based on an index. When you buy a share of that ETF, you gain proportional exposure to all the stocks within it.

So, if you’re starting small, you can still reap the benefits of diversification without needing to pick and purchase dozens of individual stocks.

Here are two top TSX-listed ETFs that I believe every beginner should consider, and you can buy shares in both for less than $100 combined.

Canadian market ETF

For around $36 per share, you can buy into the Canadian stock market with iShares Core S&P/TSX Capped Composite Index ETF (TSX:XIC).

While it’s not specifically a dividend-focused ETF, XIC offers a respectable yield of 2.92%, paid out on a quarterly basis.

This ETF provides exposure to a broad selection of 227 Canadian stocks, focusing predominantly on the larger companies.

Given the composition of the TSX, it’s heavily weighted towards financials, energy, industrials, and materials, sectors that include banks, oil companies, railways, and mining operations.

Performance-wise, XIC has delivered a decent annualized return of 7.3% over the last 10 years. However, where XIC really stands out is in its affordability; it charges a very low expense ratio of just 0.06%.

U.S. market ETF

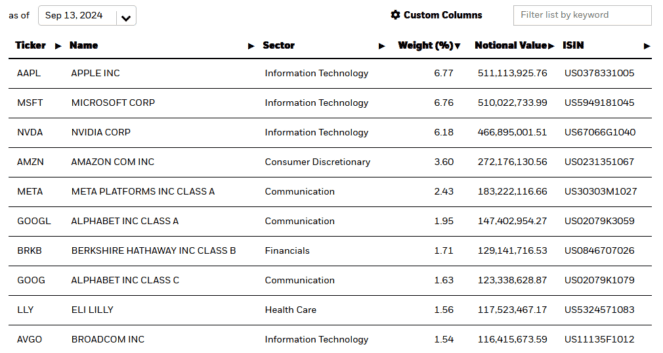

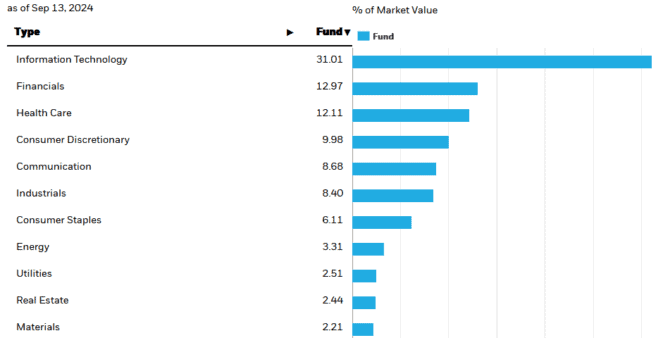

The U.S. counterpart to XIC is iShares Core S&P 500 Index ETF (TSX:XUS), which currently trades at around $46 per share.

This ETF offers broad exposure to the American market, encompassing 500 large- and medium-sized companies.

Unlike XIC, XUS features a significant concentration in sectors less prevalent in Canada, such as technology, healthcare, and consumer discretionary.

Although its dividend yield is lower at 0.98%, the growth potential more than compensates. Over the last 10 years, XUS has achieved a remarkable annualized return of 15.03%.

While slightly more expensive than its Canadian counterpart, with an expense ratio of 0.10%, XUS remains highly affordable.