You’ve likely heard of exchange-traded funds (ETFs), but did you know there’s an older version of them?

They’re called closed-end funds (CEFs), and while they’ve mostly fallen out of favour in today’s market, a few long-standing gems remain hidden in plain sight, often overlooked by newer investors.

That’s a shame because some, like the Canoe EIT Income Fund (TSX:EIT.UN), offer great opportunities for passive income, boasting high yields with monthly payouts. If you’re looking for steady cash flow, here’s why EIT.UN deserves a closer look.

How EIT.UN works

EIT.UN is built for one thing: consistent monthly distributions. Investors can count on receiving $0.10 per share, paid like clockwork in the middle of every month. While the payout hasn’t grown over the years, it hasn’t shrunk either – a stability that many passive income investors value more than variable distributions.

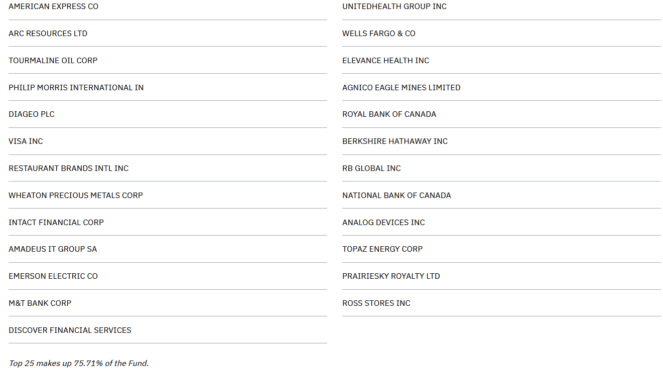

So, where does this steady cash flow come from? It’s a mix of dividends, capital gains, and return of capital generated by its portfolio. The fund splits its holdings evenly between Canadian and U.S. stocks, carefully selected for quality.

To enhance both returns and risk, EIT.UN employs modest leverage, borrowing up to 20% (or 1.2x exposure). This strategy has paid off: over the past decade, EIT.UN has delivered a 12.4% annualized return (with distributions reinvested), significantly outpacing the S&P/TSX Composite Index, which returned 9% over the same period.

Before you invest…

CEFs differ from ETFs in one important way: there’s a greater chance for the market price (what you pay to trade it) to diverge from its net asset value (what it’s actually worth).

ETFs avoid this issue with a “creation/redemption in-kind” mechanism that keeps their market price and NAV tightly aligned. CEFs, on the other hand, don’t have this feature, which is why they’ve become more obsolete in recent years.

As a result, CEFs can trade at a premium (above NAV) or a discount (below NAV) depending on investor demand. The general rule? Always try to buy a CEF at a discount to its NAV – after all, why overpay for the fund’s holdings?

As of the December 10 market close, EIT.UN has a NAV of $15.89 and a market price of $15.67, meaning it trades at a slight discount. This makes it an acceptable buy, but keep in mind there’s no guarantee the price will converge to NAV, and historically, EIT.UN has always traded at a discount.