Dividend stocks are a key part of a well-diversified portfolio. They offer us investors with an extra source of income to supplement our employment income, fund our dreams and support our retirements. So, if you don’t have this set up, let’s take a look at how to do it.

Here are three monthly dividend stocks I would invest in today.

Chartwell Retirement Residences: A 3.7% dividend yield

Chartwell Retirement Residences (TSX:CSH.UN) is Canada’s largest provider and owner of seniors housing communities, from independent living to long-term care. This is a business that provides recurring monthly revenue from tenants of Chartwell’s properties. It’s also a business that’s growing due to the aging population trend.

This monthly dividend payor has provided its shareholders with monthly dividend income since its initial public offering (IPO) in 2003. While the monthly dividend has come down since the early days, it has been steady since 2009. In 2016, the dividend was increased from $0.04 per share to $0.05 per share. It has held steady since then.

Today, Chartwell is yielding 3.7%. It’s benefitting from rising revenue, cash flows, and margins. This is backed by rising occupancy levels and strong demand.

Northland Power: A 6.5% dividend yield

With clean-burning natural gas, wind, and solar assets, Northland Power Inc. (TSX:NPI) is well-positioned in the renewable energy world. Northland Power has been paying out a monthly dividend since 2003. The dividend currently stands at $0.10 per share, and the stock is yielding 6.5%.

Northland has three major projects that will enter commercial production in 2025 and 2026. This means that the company’s operating cash flow will be boosted significantly in the coming years. Demand for projects remains strong, and Northland has a strong global presence to meet this demand.

For those worried about the sustainability of Northland’s dividend, keep in mind that the company has an investment-grade balance sheet. Also, the company doesn’t have a U.S. presence, so it will be unaffected by tariffs.

Peyto: A 7.45% dividend yield

Peyto Exploration and Development (TSX:PEY) is one of Canada’s low-cost natural gas producers. Peyto stock currently pays out a monthly dividend of $0.11 per share and is yielding 7.45%.

Peyto’s dividend is backed by its prolific assets, which have a high-return production profile. This means high recoveries and predictability, which translates into lower risk and lower capital requirements—all good things for Peyto and its dividend investors.

In 2024, Peyto’s cash flow from operations was $713 million. Also, Peyto delivered industry-leading cash costs, an operating profit of 66%, and a 24% profit margin. This happened despite natural gas price weakness in 2024.

The outlook for natural gas is positive as new liquified natural gas facilities open up and ramp up here in Canada. Peyto will be one of the producers that supply these facilities. North American natural gas is in high demand from around the globe, as it’s a cheap and reliable energy source. The tariff situation in the U.S. has made Canadian natural gas even more valuable.

How I’d invest $15,000

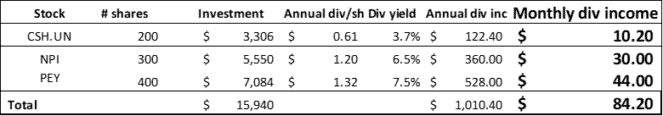

As you can see from the table below, I would invest my $15,000 in these three dividend stocks with a heavier weighting in the higher-yielding ones. This would give me $1,010.40 in annual dividend income and $84.20 in monthly dividend income.