Sometimes the laziest investment methods are the most effective. And few strategies are lazier or more reliable than plunking $10,000 into an exchange-traded fund (ETF) that passively tracks the S&P 500 Index and letting time do the heavy lifting.

No, this isn’t a globally diversified portfolio. And yes, it leans into America’s long streak of outperformance. But the sheer simplicity, low cost, and historical returns make this a strategy worth considering, especially if you’re looking to invest with minimal effort.

Here’s how it works, and how to get started as a Canadian investor.

Why the S&P 500?

The S&P 500 is a stock market index that tracks 500 of the largest publicly traded companies in the U.S. To be included, a company must meet specific requirements around size, profitability, and liquidity. It’s also market-cap weighted, which means bigger companies get more weight in the index.

This structure gives you several advantages: low turnover, automatic exposure to sector leaders, and what’s known as a “self-cleansing” effect – winners to the top, while laggards naturally fall off. It’s no wonder that 88% of actively managed U.S. large-cap funds underperformed the S&P 500 over the last 15 years, according to SPIVA.

What History Says

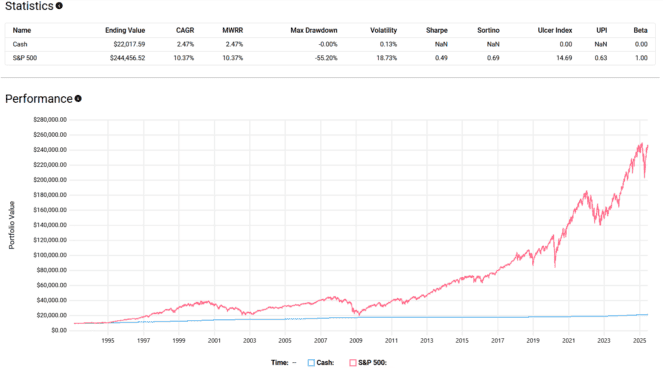

Had you invested $10,000 into the S&P 500 in the early 1990s and left it alone, you’d be sitting on over $240,000 by 2025. That’s a 10.4% annualized return, according to the backtest.

Of course, that return came with some serious bumps along the way, including a maximum drawdown of 55.2% during the 2008 financial crisis.

But the long-term trend is undeniable: patient investors who stayed the course were rewarded far more than those who left their cash on the sidelines (which only returned 2.5% over the same period).

How to Invest in the S&P 500

If you’re a Canadian investor looking to mirror that kind of performance, a great option is the Vanguard S&P 500 Index ETF (TSX:VFV).

It trades in Canadian dollars, so there’s no currency conversion fee, and it has a rock-bottom management expense ratio (MER) of just 0.09%. For a $10,000 investment, that’s only $9 a year in fees – a tiny cost to track one of the most influential stock indexes in the world.

So if you’re looking for an easy, proven way to invest for the long term, consider doing what the stats say works: buy the market, stay the course, and let time do the compounding.