AI has been the market’s favourite buzzword for a while now, and it’s not slowing down. Every other week, there’s a new exchange-traded fund (ETF) promising “exposure” to it. Trouble is, I’m not interested in buying hype.

I’m looking for an ETF that actually holds the companies building and running the stuff AI needs to exist: the chips, the data centres, the software infrastructure. Not just whatever’s hot on Reddit this month.

After digging through the options, I’ve landed on one ETF that does the job better than the rest right now: the CI Global Artificial Intelligence ETF (TSX:CIAI).

CIAI: The basics

CIAI is an actively managed AI-focused ETF with a 0.39% management expense ratio, which is low for an active mandate and closer to what you’d pay for some passive thematic ETFs. It has $883 million in assets under management, so it’s established and liquid enough for most investors.

Being active means the managers can adjust the portfolio based on their views of the AI space, rather than just tracking an index. That can be an advantage if you believe in their process, but it also introduces the risk that their investment calls underperform a simple passive benchmark.

CIAI: The holdings

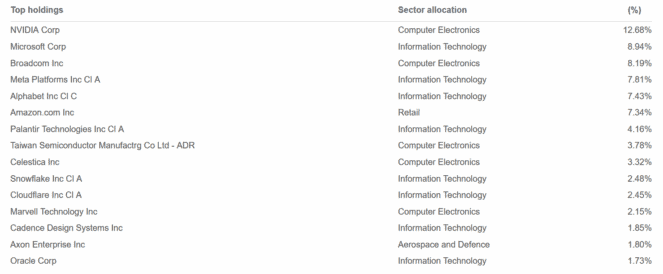

Looking at the allocations, this ETF is heavily tilted toward U.S. equities (85.32% of assets), with the rest in international names led by Taiwan (3.78%) and Canada (3.32%). It’s extremely concentrated in technology at 82% of the portfolio, with consumer services a distant second at 9.7%. The top holdings as seen below make up 76% of the ETF.

CIAI is a pure AI-tech play, with very little diversification outside the sector. The cash and equivalents position of 3.5% suggests some dry powder or a tactical buffer, but it’s small in the grand scheme.

From a bottom-up perspective, you’re getting a fund that is all-in on the U.S. tech sector, with some select global exposure to AI-related names in other regions. The narrow focus means you’ll capture the upside if AI leadership continues to drive markets, but you’ll also feel the pain if tech stalls.

For me, this works as a tactical satellite position to overweight AI and tech, and not as a core holding because the sector and country concentration are too high for a balanced portfolio.

CIAI: The bottom line

CIAI gives you concentrated, active exposure to the AI megatrend at a fee that’s unusually low for an active strategy. The heavy U.S. tech bias means it will likely move in line with the sector’s highs and lows, so it’s best suited as a tactical complement to a diversified core portfolio. If you want a targeted, actively managed AI allocation without paying the 0.65%–1% you see elsewhere, this fits the bill, but just know you’re signing up for high concentration risk.