When I think about finding the best dividend stocks in Canada, two schools of thought come to mind.

The first is yield-chasing—going after the highest payouts possible, regardless of quality. The second is dividend growth—owning companies that may not have the biggest headline yields, but consistently raise dividends year after year.

Personally, I lean toward the latter. A steadily rising payout tells you management is confident, cash flows are healthy, and the business model is durable. That’s the kind of stock I want to hold in my Tax-Free Savings Account (TFSA) for the long haul.

How I want my dividend stocks to work

The ideal Canadian dividend stock isn’t a flashy growth play. It’s a blue-chip company with a long history of rewarding shareholders.

I want to see consistent dividend hikes—not just steady payouts—because that shows resilience across market cycles. On average, these kinds of companies are large, well-capitalized, and leaders in their industries. They don’t have to dominate every headline, but they quietly compound wealth in the background.

That means balance sheet strength, reliable earnings, and a commitment to increasing the dividend even in tough years. I don’t want one-offs or yield traps that dangle big payouts but risk cutting them when times get hard. I want predictability and discipline.

Why that matters for performance

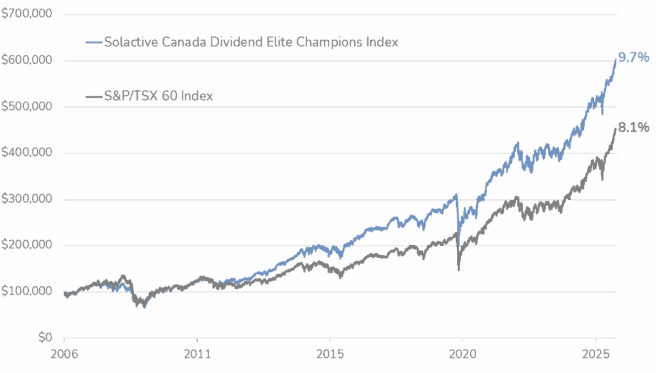

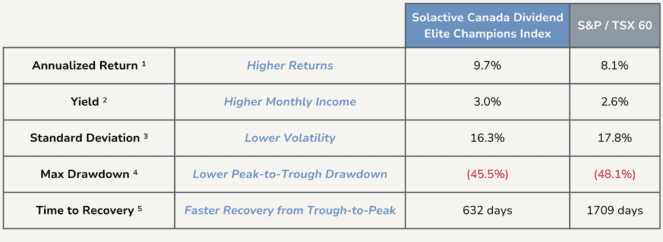

It’s not just about comfort. Backtested data shows that baskets of dividend growth “champions” not only outpace the broader market but also do so with less volatility.

They recover more quickly from downturns, pay more income along the way, and give investors fewer sleepless nights. The combination of above-average yield, lower risk, and faster recovery makes dividend-growth stocks a rare corner of the market where you don’t need to choose between safety and returns.

This is the type of compounding you want in a tax-free account. Dividends that grow faster than inflation and portfolios that hold up better when markets wobble give you the edge you need over decades.

The Foolish takeaway

So, what’s the best way to get all of this in one place without having to pick individual names? That’s where Hamilton CHAMPIONS™ Canadian Dividend Index ETF (TSX:CMVP) comes in.

It holds a portfolio of blue-chip Canadian companies (see some of the names below) that have raised dividends for at least six consecutive years, producing the exact traits I’ve just described.

Even better, it comes with no management fee until January 31, 2026, after which the fee is just 0.19%. Currently, the ETF is paying a 2% yield with monthly dividends.