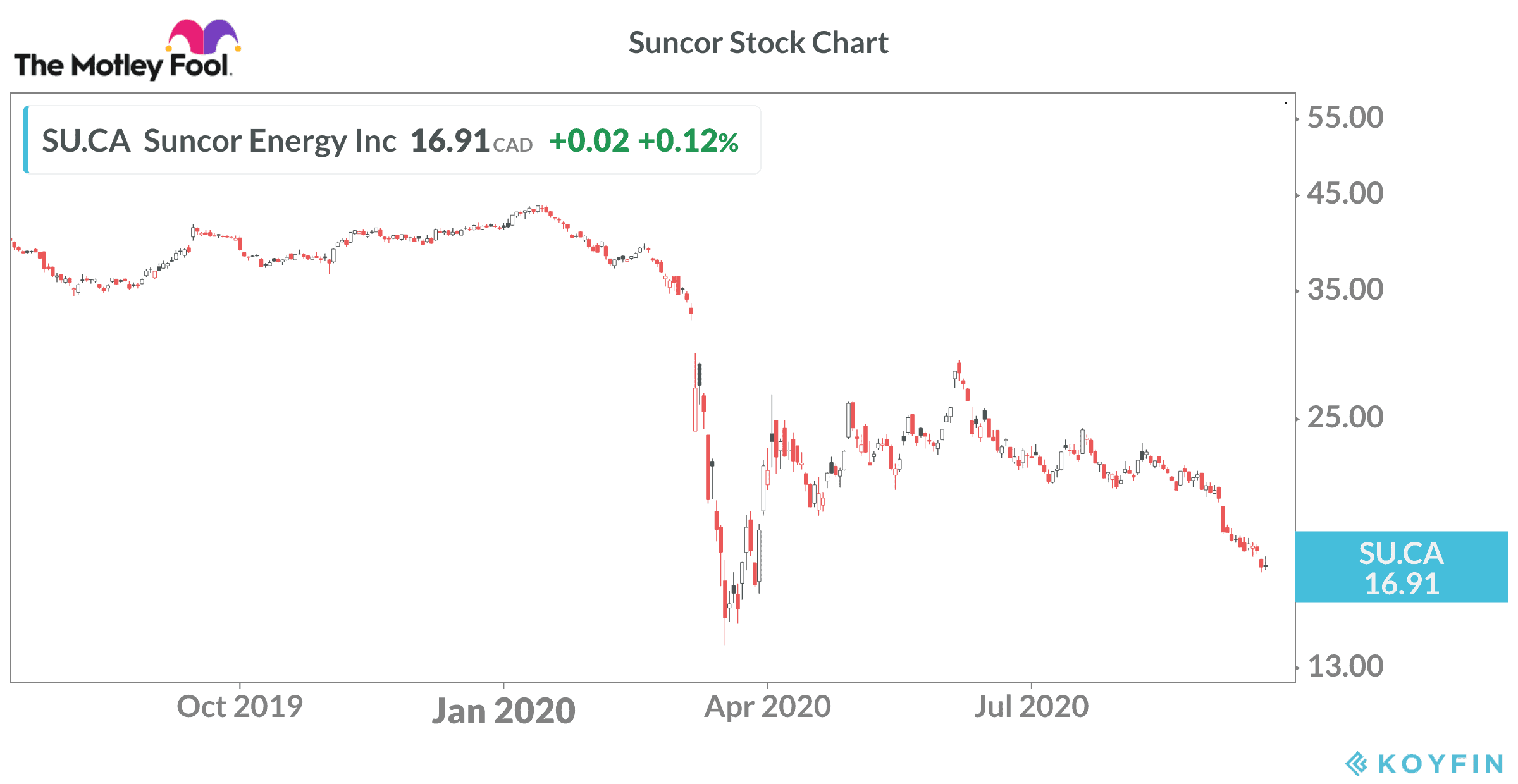

The share price of Suncor Energy (TSX:SU)(NYSE:SU) is closing in on the lows it hit during the March market crash. Contrarian investors with an eye for value wonder if Suncor stock is oversold today.

Suncor’s stock price

Suncor stock trades below $17 per share at the time of writing. The shares hit a closing low near $15 in March, so the stock isn’t too far off that mark. This is a sharp contrast to the performance of many top stocks in the TSX Index over the past six months.

Suncor is Canada’s largest integrated energy company with production, refining, and retail operations. The balanced nature of its businesses across the full spectrum of the value chain traditionally served as a good hedge against falling oil prices. In previous downturns in the oil market, Suncor stock held up well relative to peers that only have production assets.

However, the current situation is unique in that the recession and collapse in oil prices is due to a health crisis. Pandemic lockdowns forced airlines to cut capacity by more than 90% in recent months. Commuters left their cars in the garage, as they worked from home. Trucking companies parked fleets of delivery vehicles amid a drop in demand for goods, as stores closed and factories shut their doors.

The price of WTI oil fell from US$60 near the start of the year to a brief plunge below zero in April. China’s reopening helped oil demand start to recover in the spring, but the momentum stalled out over the course of the summer. Global fuel demand remains weak, and WTI oil is struggling to build a base above US$40 per barrel.

Airlines won’t see capacity return to 2019 levels for at least three years, if ever. Jet fuel is one of the products created by Suncor’s four large refineries.

Suncor’s Petro-Canada gas stations appear busy now that people are cruising around town again, but this might not be enough to help offset the challenges in the upstream and refining units.

Suncor earnings

Suncor slashed the dividend by more than 50% early in the pandemic, so the board knew the company was in for a rough ride. The Q2 2020 results confirmed the challenges.

Suncor booked an operating loss of $1.49 billion in the quarter compared to earnings of $1.25 billion in the same period last year. Crude oil production dropped to 655,500 barrels of oil equivalent per day (boe/d) from 803,900 in Q2 2019. The plunge reflects the company’s response to the decline in demand by refineries as well as decisions to move scheduled maintenance forward on the calendar.

Opportunity

The integrated nature of Suncor’s businesses should show value again once vaccines are widely available and the global economy stabilizes. In fact, there is a chance fuel demand could surge in the next few years, just as oil prices take off.

Investment across the industry tanked in 2020, and that will eventually impact oil supply. Analysts on the bull side of the oil picture predict a price surge in the next five years. If that occurs, Suncor stock will ride the wave higher.

Tough times force energy companies to become more efficient, and investors normally see the benefits on the recovery. Suncor is on track to achieve $1 billion in operating cost reductions in 2020. Capital expenditures should drop by $1.9 billion.

Liquidity stood at $8.65 billion at the end of June, so Suncor has ample cash to ride out the downturn.

Should you buy Suncor stock?

Additional downside could be on the way if the broader stock market corrects heavily or if countries extend travel restrictions and enter new lockdowns.

That said, upside potential on a rebound likely outweighs the near-term risks and you get paid a decent 5% yield to own Suncor stock at the current price.

I wouldn’t back up the truck, but a small contrarian position on any additional weakness is worth considering. Suncor stock could easily top $30 when the market recovers.