The shares of Kinross Gold (TSX:K)(NYSE:KGC) surged by 7.5% on Thursday after witnessing a sharp sell-off in the previous three days. The stock has seen heightened volatility since it announced its quarterly dividend along with 2023 guidance a week ago.

Kinross Gold expects higher operating costs in 2020

Kinross Gold is a Toronto-based gold and silver mining company with business operations in six countries — including the U.S., Brazil, and Russia. On September 17, the company reinstated its 2020 guidance — originally provided in February — even before the COVID-19 restrictions started.

In a press release, Kinross highlighted that it’s on track to achieve gold production equivalent to 2.4 million ounces this year as it maintained its US$900 million capital expenditure guidance. However, the company expects its operating costs for the year to be about 40% higher from its earlier guidance of US$100 million. It blamed a recent strike at its Mauritania-based Tasiast gold mine and costs related to COVID-19 measures for fueling its operating costs this year.

Expectations of a 20% rise in gold production by 2023

Kinross Gold expects roughly around 20% rise in its gold production to 2.9 million ounces by 2023. While the company sees its 2021 gold production to be the same level as its 2020 guidance figures, it estimates 2022 gold production to rise to 2.7 million ounces.

At the same time, the mining company predicts a downtrend in its production costs of sales and capital expenditure. These lower costs should help it strengthen its free cash flow.

Kinross Gold expects to achieve its 2023 guidance by boosting production at many of its plants — including at Kupol gold mine in Russia.

The recent trend in financials and growth estimates

During the ongoing pandemic, not many companies have been able to sustain their revenue growth. Nonetheless, Kinross Gold’s revenue rose by 11.9% and 20.2% year-over-year (YoY) in Q1 and Q2, respectively. The company has reported positive revenue growth in the last five consecutive quarters.

Bay Street analysts not only expect the ongoing positive trend in Kinross Gold’s revenue to continue, but they expect it to accelerate in the coming quarters. According to analysts’ estimates, the company is likely to report a 35% and 27% YoY increase in its Q3 and Q4 2020 revenue, respectively.

The higher revenue is expected to help the company report solid 2020 earnings of US$0.67 per share — nearly double as compared to US$0.34 in 2019.

It’s noteworthy that Kinross Gold’s profitability has significantly improved in the last couple of years. In 2019, the company reported an adjusted net profit margin of 12.1% — considerably higher than just 4% in the previous year. Analysts expect its 2020 bottom-line margin to expand beyond 20%.

Could its stock continue rallying in Q4?

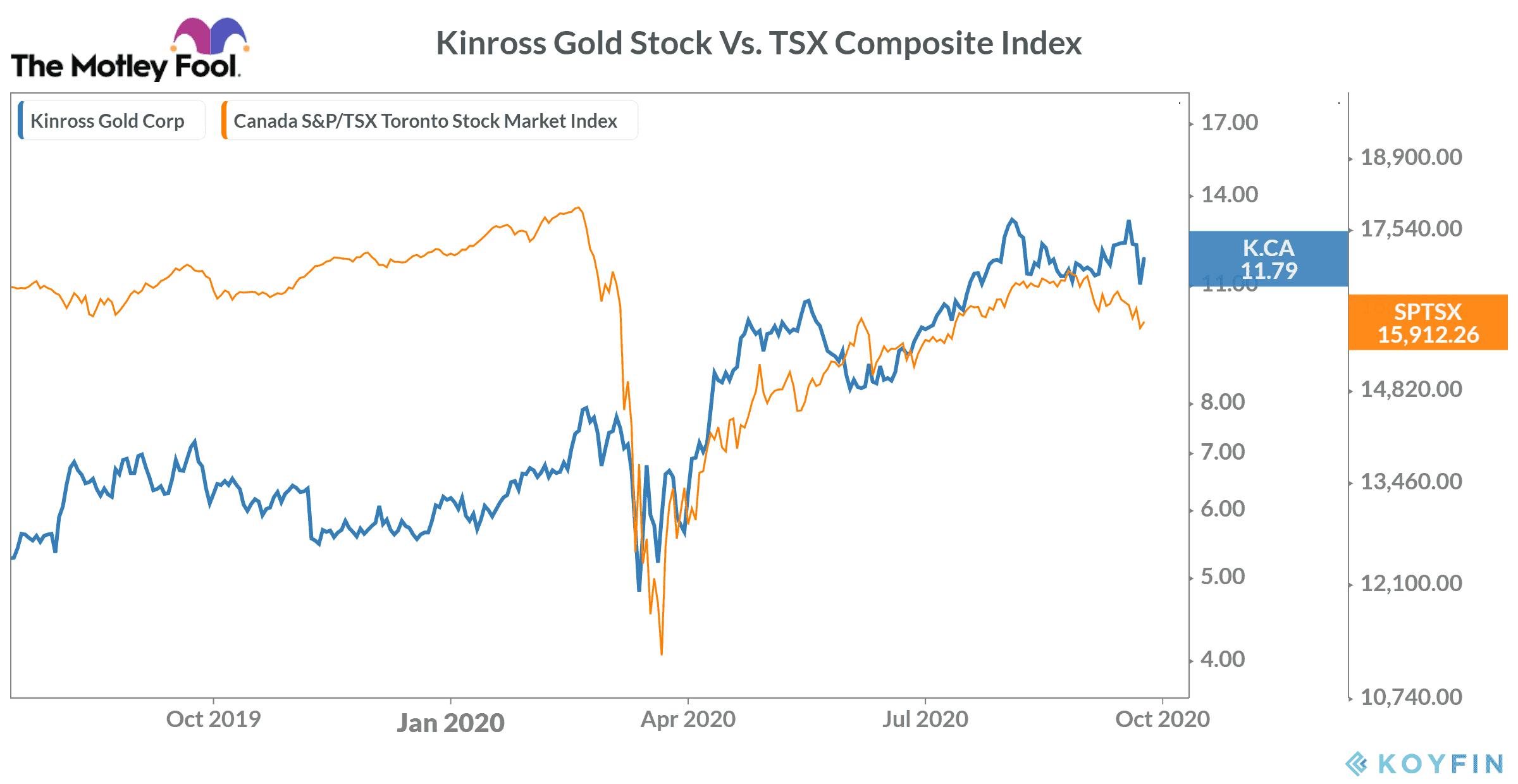

Kinross Gold stock has already risen by 79% in 2020 so far compared to a 6.2% decline in the TSX60 Index. I expect its recent 2023 business outlook to boost investors’ optimism, which could help its stock rise further in the fourth quarter.