The TSX continues to show strong momentum. This is despite the looming second wave and the continued risk of more shutdowns. If and when the reality of more shutdowns hit, the market will surely crash. When this happens you should consider buying stocks that are relatively unaffected by this crisis. Here are two safe dividend stocks to buy when the market crashes.

Fortis: A safe and highly predictable dividend stock to buy

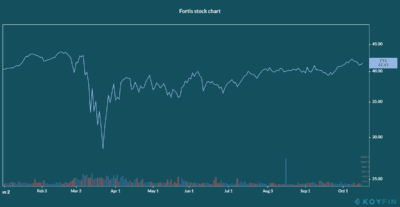

As a North American leader in the regulated gas and utility industry, Fortis Inc. (TSX:FTS)(NYSE:FTS) is a very safe bet. Fortis stock currently yields a very respectable 3.71%. The stock fell sharply in March as the pandemic hit. But we can see from its quick recovery that this stock can’t be held down for long.

So why the sharp recovery in the stock price? And why can we expect the same to happen if the market crashes again? Whenever investors start to panic in a crisis, they take down all stocks. Even stocks like Fortis, which is pretty insensitive to the economy. This is the time when we can buy these stocks at major discounts. In the long run, Fortis will still be around powering up our homes and out businesses. It provides an essential service.

Given the essential nature of Fortis’ business, it follows that this company’s dividend has been reliable. Fortis has 46 years of consecutive dividend increases under its belt. And looking ahead, Fortis remains committed to 6% average annual dividend growth until 2024. It is one of the safest and most predictable stocks to buy when the market crashes.

NorthWest Healthcare REIT: A defensive healthcare exposure yielding 6.9%

NorthWest Healthcare Properties REIT (TSX:NWH.UN) is another pretty defensive stock to buy when the market crashes. This one is quite different though. As a real estate investment trust (REIT) that focuses on healthcare real estate, Northwest Healthcare Properties has long-term demographics on its side. The population is aging, interest rates will remain low for the foreseeable future, and strong demand supports its value.

Yes, the pandemic has resulted in sharp growth in e-health solutions. This is undoubtedly an area of strong growth. But there’s still a big chunk of healthcare that can’t be performed virtually. NorthWest is a part of all areas of healthcare. From hospitals, to imaging clinics, to general medical buildings, NorthWest is part of prime healthcare real estate.

A key measure of performance for NorthWest is occupancy levels. Portfolio occupancy is stable at 97.3%, with the international portfolio’s occupancy also stable at 98.8%. While the pandemic has certainly negatively affected the REIT, its business remains steady and strong.

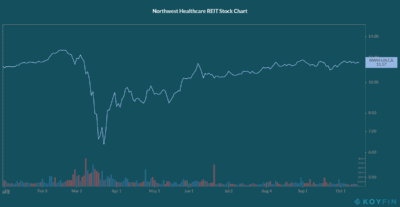

NorthWest continues to expand in Europe and it continues its deleveraging process. Compared to Fortis stock, NorthWest Healthcare REIT is currently yielding a much higher 6.9%. The REIT estimates its net asset value to be $12.37. This compares to its latest trading price of $11.55.

The chart below shows NorthWest Healthcare REIT’s quick rebound after getting hit in March.

Like Fortis stock, NorthWest rebounded quickly after the selloff because of its defensive characteristics.

The bottom line

When the market crashes in the second wave of the virus, we must consider which stocks to buy. I recommend buying safe dividend stocks on the cheap. Fortis stock and NorthWest Healthcare REIT stock are two to consider. They are both strong, defensive companies that will weather the storm and come out ahead in the long run. Any weakness in the stocks is a good opportunity to buy these well-run businesses.