Some of the best stocks to buy over the last six months have been recovery stocks. However, two stocks that have lagged the market and continue to trade undervalue are Air Canada (TSX:AC) and Cineplex (TSX:CGX). The massive discount in both stocks relative to their historical standards has many Canadians looking at these as top stocks to buy right now.

There’s certainly no question that both stocks present a major opportunity when the pandemic ends, and they can begin to rebound.

However, there’s also a reason Cineplex and Air Canada have lagged the market and continue to trade at these massive discounts to their pre-pandemic prices.

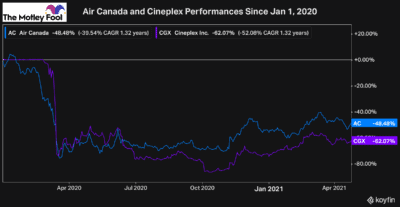

Since the start of 2020, Air Canada is down 48%, and Cineplex is down 62%. And while this looks opportunistic, the size of a discount in stocks like these isn’t necessarily what determines if they are the best stocks to buy now.

It’s the price of the stock combined with its current position and outlook that determines its value. And clearly, over the last year, these lower prices are the values that the market has decided that these stocks are worth.

It’s important to understand this because while these stocks may return to their pre-pandemic prices someday, it almost surely won’t be anytime soon.

Although the coronavirus pandemic will only impact Air Canada and Cineplex for a little while longer, they’ve lost a tonne of value during the pandemic. So it will likely be quite a bit of time before the business is worth what it was before the pandemic hit.

Which is the best stock to buy right now?

Given that both stocks are in the same position and are waiting for the pandemic to end so they can return to business as usual, the best stock to buy right now will be based on personal preference.

Air Canada is the stock with more risk right now. The stock is losing a tonne of value each day its operations are put on hold. With that said, though, Air Canada and the travel sector have the potential to bounce back a lot faster than Cineplex.

Cineplex, however, has a more dominant position in its industry. So there’s a lot less risk buying the stock now, especially if the pandemic lasts longer than we all expect it to in Canada.

It’s worth noting that analysts favour Air Canada stock. However, neither company offers incredible value that makes them must-buys today.

A Canadian stock with even more value than Cineplex or Air Canada

If you want to buy a Canadian stock that is truly undervalued, I’d recommend Corus Entertainment Inc (TSX:CJR.B).

While Corus was impacted at the start the pandemic, it has already shown it can handle the adversity and continues to recover and turn its business around.

Unlike Air Canada and Cineplex, which are both still down significantly since January 1, 2020, Corus investors have seen a return of more than 20% through that time.

Despite this recovery and the strong returns that investors have made, the stock still trades ultra-cheap. That’s why, although Air Canada and Cineplex may look undervalued, Corus is one of the best stocks to buy now.

The company is highly profitable, and its stock trades at a forward price to earnings ratio of just 6.7 times. Corus even returns cash to shareholders quarterly with its 4% dividend. And according to analysts, the stock offers more growth potential than Cineplex or Air Canada over the next year.

With a target price of nearly $8.00, Corus has more than 30% upside potential. So if you’re looking for one of the best value stocks to buy today, Corus is one of the cheapest in Canada.