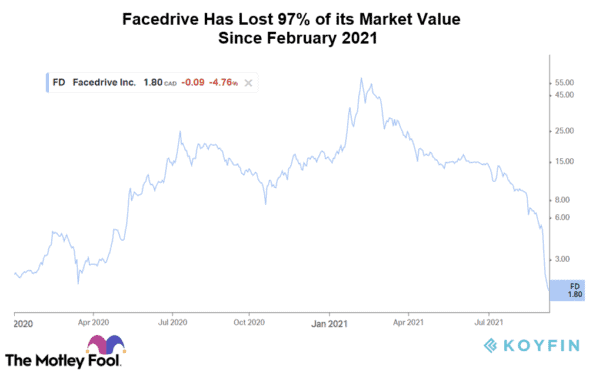

Experts often claim that investing is not complex, but people make it so. However, it’s not that simple either. Look at Canada’s ride-hailer stock Facedrive (TSXV:FD). The company donned close to a $6 billion market cap early this year. Fast forward today, it’s a mere $170 million company.

Facedrive stock continues to dig deeper

Strangely, the stock’s movement last year got many to believe in its growth story and made jump in the rally. That’s why FD stock touched $60 apiece in February 2021 from $2 levels early last year. Notably, those who got out in time must be very fortunate, but those who did not must be sitting on hefty losses.

Undoubtedly, the drop was quick and disastrous, but there were indeed several red flags that could have saved investors from a deep dig in the pocket. It’s easier to lecture looking at it in hindsight. However, basic “why’s” and “how’s” from a realistic perspective would have been enough.

First, Facedrive was a loss-making venture. In 2020, the company generated $4 million in revenues and reported almost $18 million in net losses. A company with a mere $4 million in annual revenues reached a record market cap of close to $6 billion early this year.

Even if tech stocks are valued higher, Facedrive reached an exorbitantly higher valuation. This was a major warning for investors. As Peter Hodson in the Financial Post rightly pointed out, instead of questioning why Facedrive stock fell so much, a bigger question is why it was worth nearly $6 billion.

Even if you don’t want to fall into financial analysis and valuation jargon, a quick glance at Facedrive’s reviews on the Google Play Store would have given you a fair idea about its growth prospects.

What exactly went wrong?

Facedrive did fairly okay early last year, as its mainstay ride-hailing vertical saw some encouraging developments. However, the company got engaged in unrelated acquisitions during the pandemic.

Apart from ride hailing, the company made acquisitions and forayed into food delivery, health care, EV subscription, clean energy, and more. During this haywire expansion, the company lacked communication with shareholders about its strategy, growth plan, and direction.

Initially, it had a differentiated plan to take on popular ride hailers and simultaneously addressing climate issues. Perhaps the competitive advantage of having a cleaner fleet soon lost its charm when established players announced to turn their fleet into EVs.

Moreover, FD’s ride hailing took a back seat amid the pandemic, and food delivery became a core business. Perhaps food delivery, too, is an uphill battle given strong competition and wafer-thin margins.

Troubles only multiplied for Facedrive in the last few weeks. Top executive departure and stake sell from co-founder Imran Khan have only fueled the stock fall. To add to the woes, Khan said that Facedrive plans to file for bankruptcy as early as this month.

Unsurprisingly, there has been a massive selloff in Facedrive stock so far in September. It has fallen for the last six consecutive trading sessions and has collectively lost 70% of its market value this month alone.

The Foolish takeaway

Those who stayed away from Facedrive must be enjoying POMO (pleasure of missing out) these days. We have seen plenty of stocks reaching exorbitant levels recently for no apparent reason. That’s why it makes sense to stay away from the noise and take calculated risks with fundamental analysis.