TFSA investors have a difficult task: finding the right stocks to buy. I mean, it’s not like there’s a lack of information out there. There actually might be too much information. At Motley Fool Canada, we try to be the place to go for reliable, top-quality information and ideas. Because top stock ideas are everywhere, it can be hard to evaluate which of the “top stock” ideas to buy are worth buying and which are actually what they claim to be.

Please read on for three top stocks that are actually the epitome of top stocks. They’re stable, defensive, cash flow machines that are here for the long haul and perfect for your TFSA.

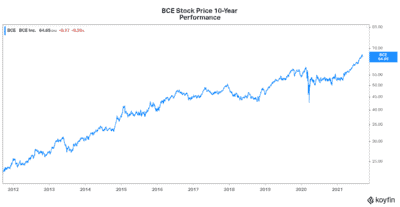

BCE stock: A top TFSA stock for regular and stable income

The reasons for adding BCE (TSX:BCE)(NYSE:BCE) stock to your TFSA portfolio are many. With BCE, you get predictability. You get dominance. And you get growth, as the telecom giant expands its offering and its services. Lastly, you get a reliable and growing dividend. What’s not to like?

BCE has built a very attractive moat around itself. Well, the government’s regulations also help. But the fact is that it takes billions of dollars to build telecommunications networks. And BCE, along with the other two telecom giants have made these crucial investments over the years. They currently control the market, with 90% market share in terms of both subscribers and revenue.

And this shows in the financials of BCE. For example, the company has consistently generated strong cash flows over the years. Of course, some of it is given back to investors. In fact, BCE’s dividend yield is currently a very generous 5.4%. This translates to more than $4,000 in dividend income if you invested the full TFSA contribution limit of $75,000 in BCE.

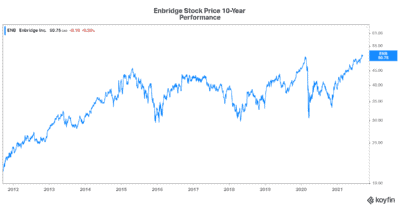

Enbridge stock: A top TFSA stock for its income stream and upside potential

Enbridge (TSX:ENB)(NYSE:ENB) is one of North America’s leading energy infrastructure companies. It’s a top TFSA stock for two reasons. The first reason is its dividend yield. With a current yield of 6.57%, Enbridge is clearly a money-making proposition. Secondly, the stock is undervalued. Therefore, it has big upside potential. Buying it for your TFSA gives you this upside, or capital appreciation, tax free.

So, why is Enbridge a stock to own in your TFSA for the long haul? Well, contrary to some who have major concerns regarding Enbridge’s sustainability, I believe that Enbridge will make a smooth transition to a cleaner, more sustainable business model. In fact, Enbridge is investing heavily in clean, renewable opportunities.

Also, it’s widely recognized that natural gas will play a big role in the transition to clean energy. Luckily for Enbridge, it transports nearly 20% of gas consumed in the United States. Also, it is North America’s third-largest natural gas utility. This business has supported very attractive shareholders returns for decades. For example, Enbridge has 26 years of dividend growth at a 10% compound annual growth rate. This has been driven by Enbridge’s predictable business that has resilient and long-life cash flows.

Loblaw stock: Stick this in your TFSA for defensive exposure to the consumer

Loblaw Companies (TSX:L) is Canada’s largest food retailer and leading pharmacy outlet. It has survived and thrived, despite all of the new competition from the likes of Walmart and Costco. The grocer has also beefed up its position in the retail world with its acquisition of Shoppers Drug Mart.

At the end of the day, it’s the financial results that are the true judge of a company. So, let’s evaluate its performance. In 2020, Loblaw generated more than $4 billion in free cash flow. So far in 2021, the company generated more than $2 billion in free cash flow.

Loblaw stock has stood the test of time.

Motley Fool Canada: The bottom line

TFSA investors have always been on the search for top stocks to own. The three discussed in this Motley Fool Canada article are a good place to start for attractive tax-free returns.