Suncor Energy (TSX:SU)(NYSE:SU) stock is a prime example of operational and financial excellence. But there’s a problem. As one of Canada’s leading integrated oil and gas companies, it is in the wrong sector. I mean, the oil and gas sector is experiencing what some believe is a slow death. This has resulted in ultra-cheap valuations for most energy stocks. In short, many of them are value stocks. Please read on as I highlight why I believe that the market has it wrong. This Motley Fool article will explain why Suncor Energy stock is actually here to stay as well as why it is grossly undervalued.

Suncor Energy stock: It’s all about the price of oil

To start off, let’s take a look at the price of oil — where it’s been, where it is today, and where it’s heading. In the last year, oil has soared from $40 per barrel to just over $70 per barrel. This represents an 80% increase. Short-term demand is recovering. Also, it’s projected that long-term demand will grow steadily. This signifies continued strong oil prices. It’s a seismic shift that has had significant implications for energy companies. For example, Suncor Energy is awash in cash. It’s riding high on a sea of good fortunes.

Although Suncor management has no control over the price of oil, it has done a stand-up job with the variables that it does have control over. And this is what makes Suncor a top energy stock. For example, Suncor has worked hard on improving efficiencies and cutting costs. In the last quarter, Suncor generated $2 billion in operating cash flow. In the last six months, Suncor raked in $4.4 billion in operating cash flow.

Value stock: Suncor trades at depressed valuations but financial results are soaring

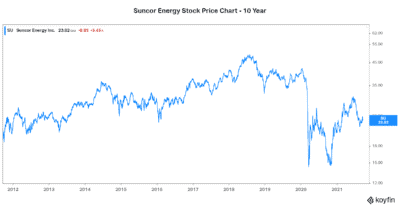

Suncor stock has been hit hard in the last little while. Since June, the stock is down 22%. This price action is unjustified, in my view. While Suncor has felt the burn of rising natural gas prices and maintenance shutdowns, the longer-term picture is bright.

I say this because of a few factors. Firstly, all of Suncor’s operations are running at full steam, as maintenance work is complete. Secondly, Suncor has completed its growth phase, which is a highly capital-intensive phase. The years ahead will see deleveraging, higher margins, and, ultimately, increased shareholder returns. According to Suncor management, we can look forward to a 25% compound annual growth rate (CAGR) of its dividend.

Suncor is taking its place in the new world of clean energy

Previously, I’d mentioned that Suncor stock is in the wrong sector. Simply put, investors are shunning the sector. They want “clean” energy companies. I said that this is why it’s trading at “value stock” levels. On the company’s second-quarter conference call, this attitude was exemplified in a couple of points. The first one is the length of the conference call. It was shorter than usual. Fewer investors are interested, and it shows. The second one was in the number of questions. Needless to say, there weren’t very many. But this lack of interest is good for those of us who are looking for undervalued stocks.

I remember not too long ago when Suncor was an investor darling. It was difficult to find anything negative written about the stock. It was trading above $50, and the widely held opinion was that it would rise “forever.” Well, that overly optimistic attitude was reflected in the stock’s valuation. As you know, it fell hard from that +$50 level.

Today, we are in the opposite scenario. We have in Suncor an undervalued gem that’s churning out cash flow while securing its long-term future and viability. It’s investing in carbon capture and reducing its carbon intensity. It’s also investing in clean energy generation, such as wind and solar energy.

Motley Fool: The bottom line

The bottom line here is simple: Suncor is an energy stock that’s undervalued for reasons that will not hold up in the long term. I fully expect that in time, the stock will rise up out of this undervalued territory. The fundamentals speak volumes — rising shareholder returns will pull Suncor out of the gutter.