Fortis (TSX:FTS)(NYSE:FTS) is one of the most popular stocks in Canada, and rightly so. It’s a massive business with incredibly diverse and robust operations that has increased its dividend payment to investors for nearly 50 years.

Because the stock is so safe, though, it’s a role player in your portfolio. Fortis is there to give your portfolio stability and add to your passive income. The stock, though, will almost surely be one of your slowest-growing businesses.

And for some investors, a highly safe stock paying a 3.9% dividend is ideal. For most investors, though, there are far more dividend stocks that are almost as safe but offer far more growth potential, both with the dividend and the share price.

So, if you’re looking for a high-quality dividend stock to buy today, here are three that I think are better buys than Fortis.

A top Canadian utility stock with green energy exposure

If you really want a safe stock and still want an investment in the utility industry, one of the safest industries you can invest in, I’d strongly consider a stock like Algonquin Power and Utilities (TSX:AQN)(NYSE:AQN).

Algonquin has a lot of the qualities Fortis has. It’s predominantly a utility stock, it has operations in several jurisdictions, and it’s a Canadian Dividend Aristocrat.

However, Algonquin also offers a lot more opportunities for growth with its green energy segment. The company’s renewable energy assets currently make up about one-third of its business. So, as the industry naturally grows, Algonquin should see a significant boost to sales.

Furthermore, Algonquin stock also yields more than Fortis, currently at about 4.8%. So, if you’re looking for highly safe utility stock but want a higher yield and more potential for long-term growth, Algonquin is one of the top dividend stocks to consider today.

A top telecom stock to buy instead of Fortis

Another company with a higher dividend and more long-term growth than Fortis is BCE (TSX:BCE)(NYSE:BCE), the largest telecom stock in Canada.

Telecommunications aren’t as defensive as utilities, but they are still highly resilient. Having access to the internet and communication is almost as important as having electricity, water, and heat. So, although BCE is not considered as safe as Fortis, it’s still one of the safest stocks you can buy in Canada.

Plus, it offers far more long-term growth potential and, like Algonquin, pays a dividend that yields considerably more than Fortis’s 3.9% yield, currently at 5.5%. This makes it another excellent dividend stock that, in my view, is a better investment than Fortis.

And with 5G technology still rolling out across Canada, BCE has years of growth potential ahead of it. So, if you’re looking for a high-quality, dividend-growth stock to buy today, I’d strongly consider BCE over Fortis.

A top dividend-growth stock to buy now

Lastly is a top dividend-growth stock in the residential real estate industry, Canadian Apartment Properties REIT (TSX:CAR.UN). While CAPREIT only offers a dividend yield of 2.4%, significantly less than Fortis, the company offers far more opportunities for investors to see their investment grow in value.

Not only does residential real estate offer more growth while still being highly resilient, but CAPREIT is also one of the top funds in the industry and has been expanding its portfolio successfully for years.

If the yield is the most important factor for you, then you still might want to invest in Fortis. But if you’re just looking for a high-quality, dividend-growth stock to own for years, CAPREIT could offer far more potential.

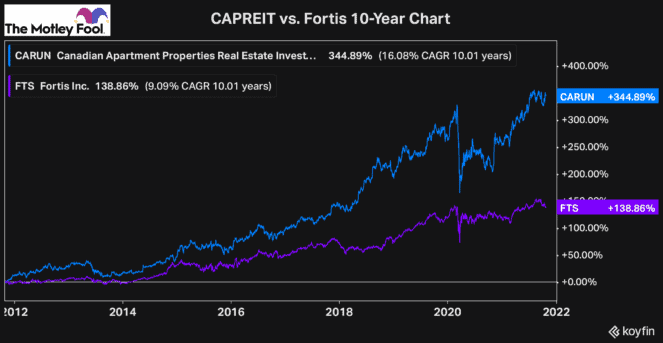

As you can see, Fortis grows at a consistent and stable pace, earning investors a compounded annual growth rate (CAGR) of more than 9% over the last decade — an impressive amount. However, CAPREIT has nearly doubled that, growing investors’ capital at a CAGR of more than 16%.

So, although it has a lower yield, the business offers more potential for growth. Therefore, if the yield isn’t everything to you, I’d strongly recommend a stock like CAPREIT over a low-risk company like Fortis, especially if you’re going to hold the stock for years.