The oil and gas sector is rallying hard these days. It’s been a long time in the making, but stocks like Suncor Energy (TSX:SU)(NYSE:SU) are reporting strong results again.

But Suncor stock is weak today off its Q4 report. Should you buy on this weakness?

Suncor Energy stock falls on disappointing earnings

In a world of rapidly rising expectations, meeting expectations means a lot. Remember, how a stock price reacts to an earnings release is more a function of expectations than of the actual result. For example, let’s say that a stock is pricing in a 100% increase in earnings. If the company reports that earnings rose by 80%, the stock would likely get hammered. By contrast, let’s say a company reports an unimpressive 5% increase in earnings, but a big decline in earnings was expected. Well, in this case, the stock would likely soar.

So, today, Suncor reported earnings that, by most accounts, were great. But they fell short of expectations. When we adjust for one-time items, Suncor’s EPS came in at $0.89 vs. a loss of $0.07 a year ago. This is great, right? Well, yes, but the problem here is that the stock was pricing in EPS of closer to $0.94. So, the stock is now falling to adjust for this.

The shortfall was due to operational problems at Suncor’s Syncrude and Firebag oil sands. One operational mishap was as simple as a heavy haul truck rear-ending a second truck at the mine. It led to the tragic death of one worker and a call for better operational and safety performance. It’s the fourth fatality since late 2020. In response, Suncor is adopting “mining safety technology” for the first time in the oil sands. Let’s hope this was the last incident.

SU stock on the TSX: The future is bright for this dividend stock

For long-term investors like us at the Motley Fool, quarterly results are not the real drivers of our decisions. They do, of course, warrant attention, but always with the bigger picture and long-term ramifications in mind. In short, although Suncor Energy did miss its earnings expectations this quarter, this does not change the long-term outlook. In fact, it won’t even affect 2022 results. Maintenance at the oil sands sites was completed and production is back to normal.

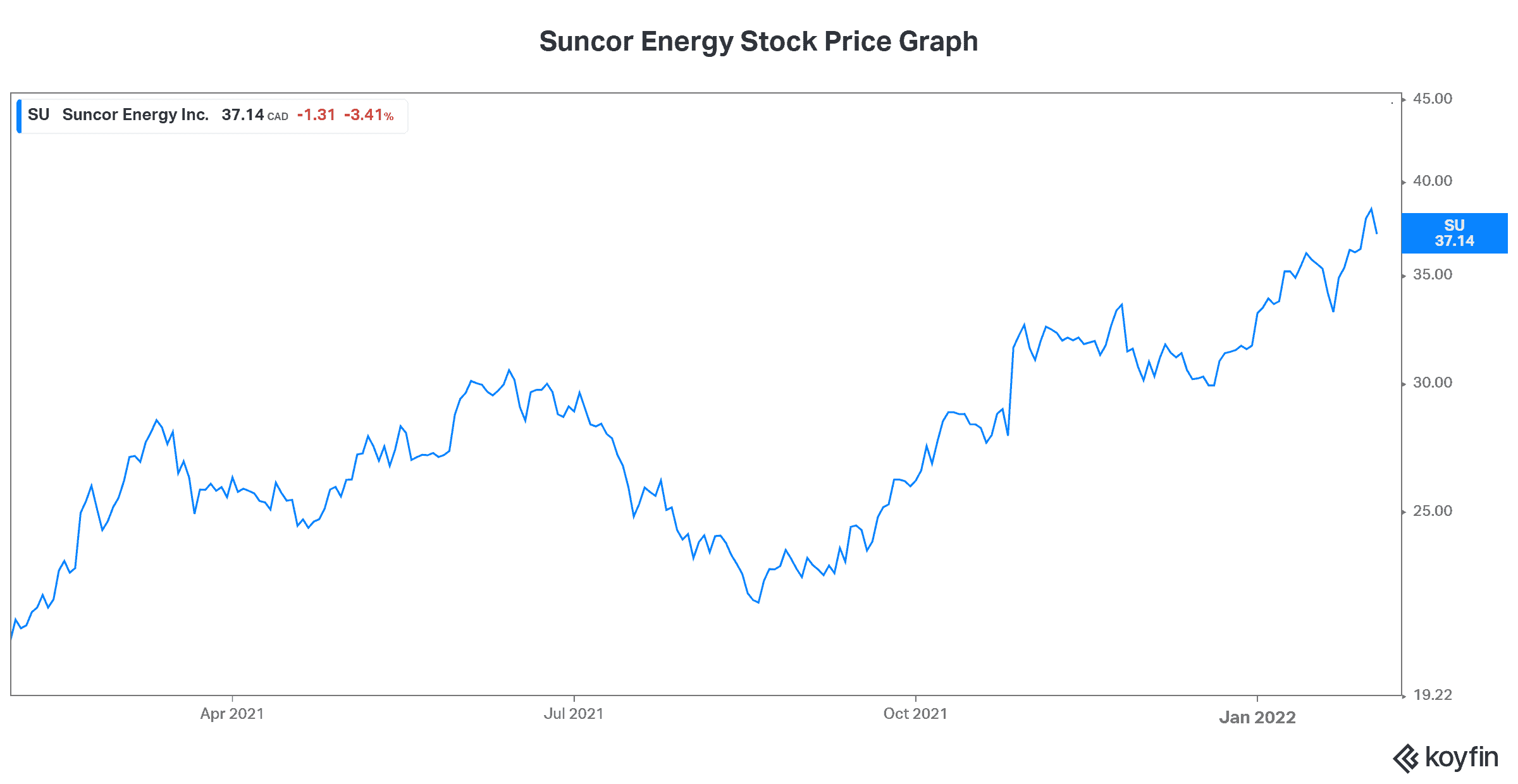

For the year, Suncor generated record funds from operations of $3.1 billion. Also, Suncor instituted an 11% increase in its dividend and further improved its financial strength. Consider Suncor’s stock price graph below. This momentum should continue in 2022.

Suncor Energy stock benefits from the energy super-cycle

As I’ve written about in past articles, oil and gas markets have been setting up for this super-cycle for a while now. It all started a few years ago, when investor sentiment shifted. This shift was caused by well-placed environmental concerns. The world was finally waking up to the facts that scientists have been warning us about for many, many years. This all culminated a few years ago into this new sense of care and respect for the environment. In turn, investors turned their backs on oil and gas (fossil fuels) companies. This lack of investor dollars, mixed with persistently low oil and gas prices, caused investment to dry up.

Companies were not investing in their assets, production was hit, and the market was paralyzed. But a few years of that underinvestment actually proved to be the kick-starter that began to rebalance oil and markets. As they say in the commodity world, “the best cure for low prices is low prices.” This is because low prices discourage investment in production, and they encourage demand — effectively rebalancing the supply/demand balance again. So, with oil and gas today, we have the supply rebalance that has taken place, but we also have a surge in demand brought on by recovering demand, as countries come out of lockdowns.

Motley Fool: The bottom line

Despite Suncor’s Q4 miss, the company remains on track to continue to benefit from the resurgence of the energy industry. Commodity prices are high, Suncor is churning out cash flow, and shareholder returns are rapidly rising. Suncor stock is a dividend stock to own today.