The Tax-Free Savings Account (TFSA) is the perfect place to compound wealth. Paying no tax really means you can elevate your returns over long periods of time. In fact, when you keep all your interest, dividends, and capital gains, you can increase your returns by as much as 10%-20% (depending on your tax bracket). That is the ideal recipe for snowballing wealth.

The TFSA is the ideal compounding machine

If you are a long-term investor (over five years), you might as well maximize your TFSA contribution limit before investing anywhere else. In fact, if you are patient, you could turn $10,000 into $150,000. Here is an example how.

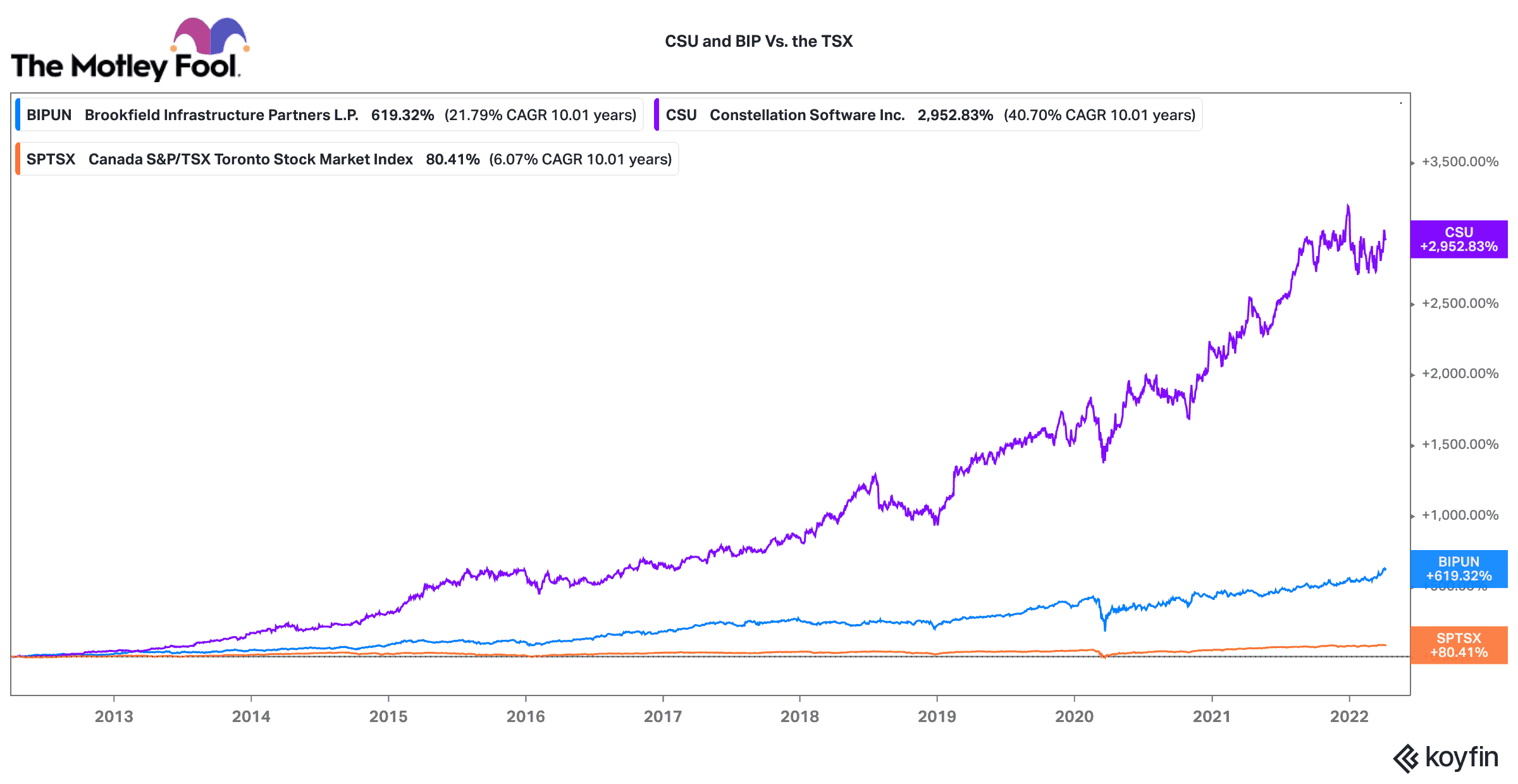

In 2012, you could have put $10,000 into your TFSA. To be diversified you could have bought $5,000 worth of Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) and $5,000 of Constellation Software (TSX:CSU).

Brookfield Infrastructure: a top income stock

Over the next 10 years, BIP should deliver a 384% total return (including dividends). The stock has delivered a 17% annual compounded return. It has effectively turned $5,000 into $24,200!

Dividends have played a major role in this story. BIP has grown its distribution by more than 10% annually since inception. If BIP was held in a TFSA, you could reinvest all the distributions into stock. If you had done so, that total return would rise closer to 500%. The $5,000 investment would be worth nearly $30,000 today!

BIP owns and invests in core infrastructure assets around the globe. There is nothing exciting about the business. However, management has done a great job buying cheap assets, fixing them up, and turning them in stable cash generating machines.

While I can’t promise similar returns going forward, Brookfield is in a very strong position today. It has a good balance sheet, high-quality assets, strong inflation-indexed contracts, and opportunities to grow organically and through acquisition. Buy this stock for the next 10 years and returns should still be pretty attractive.

Constellation Software: a perfect compounder for a TFSA

Constellation Software is one of the best performing stocks on the TSX. It is a perfect stock to own in a TFSA. Over the past 10 years, it has delivered a 2,437% total return! That is a compounded annual return of 38%. A mere $5,000 invested in 2012 and held to today would be worth $126,939!

Constellation is a unique business. It acquires mostly small, niche vertical market software (VMS) businesses around the world. These businesses have highly recurring revenues, strong economic moats, and they generate a lot of free cash. Constellation yields the cash and then re-invests it into more acquisitions. It is the ideal compounding formula.

While the company has made hundreds of acquisitions to date, it has thousands of acquisition targets in its data base. Given Constellation’s size, it is now accelerating both the number and size of acquisitions. Last year alone, it deployed around $1.5 billion of capital (its largest in history).

Constellation’s past track record may be hard to replicate. However, even if returns are halved, it could still produce very attractive long-term returns.

The Foolish takeaway

The key to success is to buy great companies like Constellation and Brookfield. Tuck them away in your TFSA for long periods of time and then do nothing. You’ll be pleasantly surprised how the power of compounding can drastically multiply your wealth.