With rising interest rates and rising inflation, the stock market is feeling dangerous to me at this time. So, I’m reining in my focus. I’m increasingly shying away from the highest-growth stocks that have zero to insignificant earnings. Instead, I’m focusing on well-established stocks that have strong cash flows and a business that’s sheltered from rising rates and inflation. In this article, I would like to review three such dividend stocks.

There is a way to invest successfully, even in this shaky market.

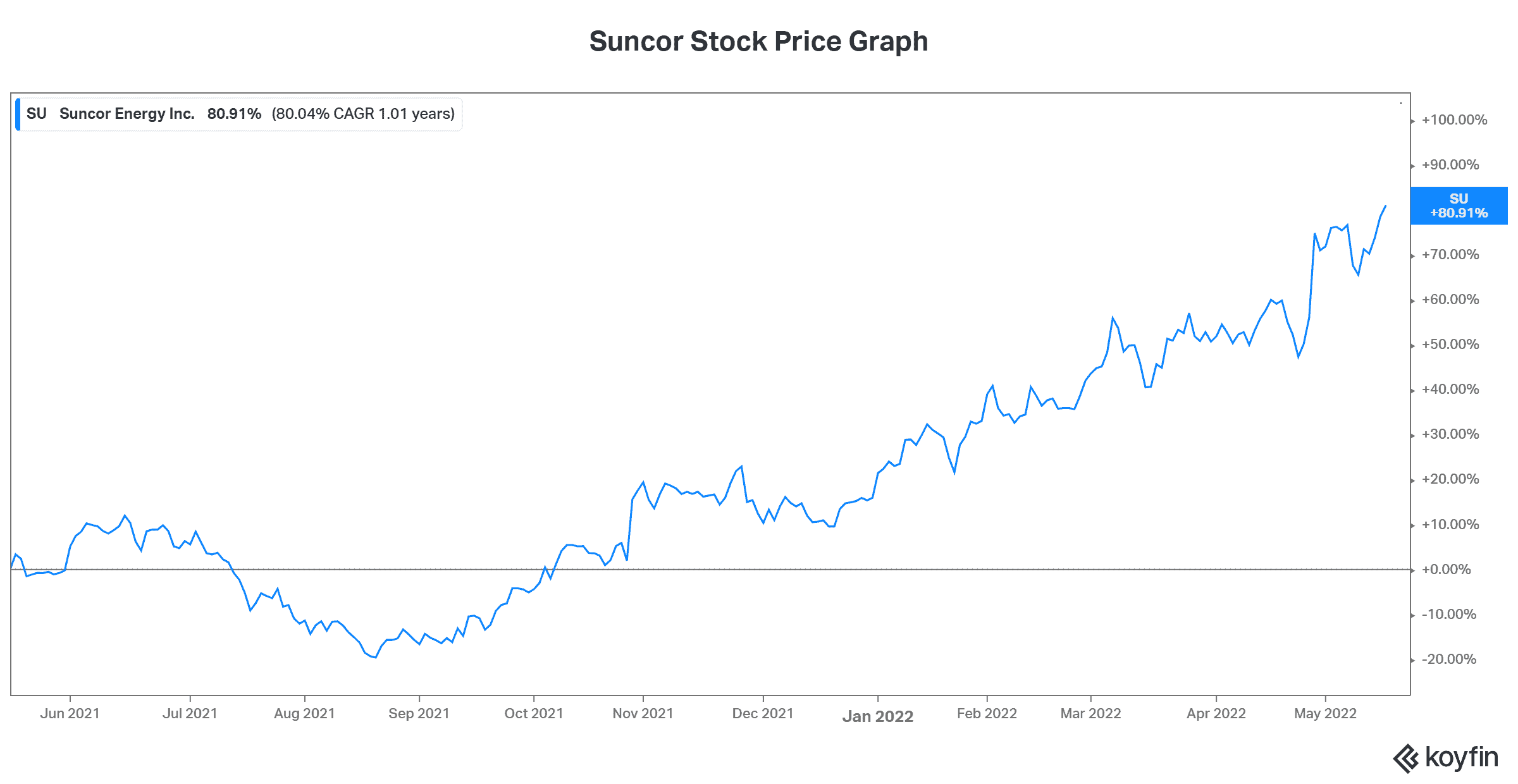

Suncor: A top dividend stock breaking records and serving as an inflation hedge

Suncor Energy (TSX:SU)(NYSE:SU) is Canada’s leading integrated energy company. It has a long history in the oil sands industry. It also has a solid refining business that evens out its cash flows through all commodity cycles. These robust cash flows have supported a steady, growing dividend over the years. In fact, Suncor’s dividend has grown at a compound annual growth rate of 13% over the last 27 years. This translates to a lifetime of exceptional investor returns.

It’s for these reasons that Suncor stock is one of the best dividend stocks in Canada today. Looking ahead, Suncor’s story is just getting better. Strong oil and gas prices and refining spreads are driving record results. Cash flows doubled to over $4 billion in the last quarter. As a result, Suncor reduced its debt significantly. It also increased its quarterly dividend by another 12%.

In summary, Suncor is a top-tier dividend stock that’s sitting pretty as a solid inflation hedge. This is the result of soaring oil and gas prices — the result of soaring demand and low supply.

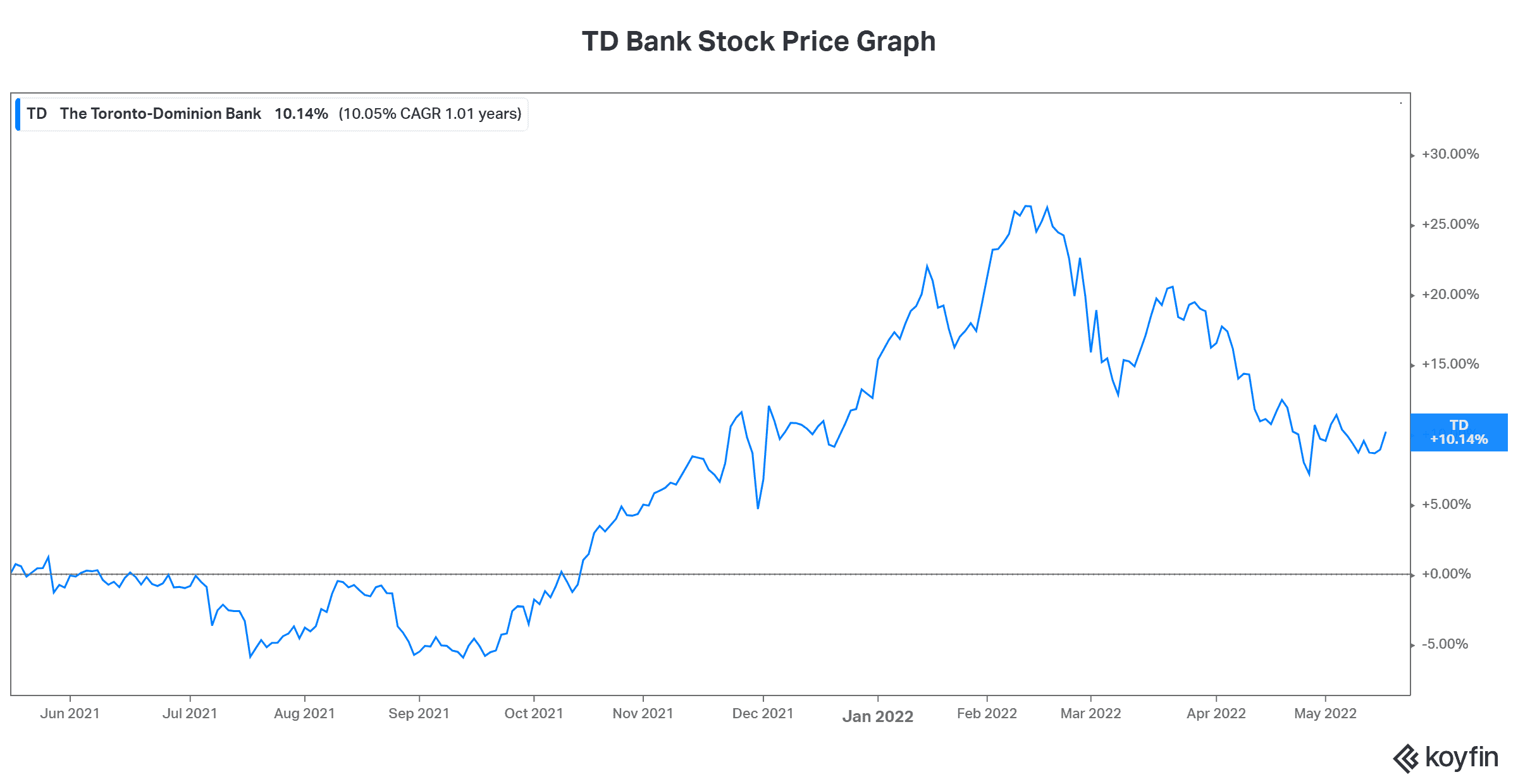

TD Bank stock: Benefitting from rising interest rates

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is one of Canada’s top banks. It’s also the fifth-largest North American bank. Finally, it’s one of Canada’s top dividend stocks. TD Bank stock has a solid history of dividend growth and shareholder returns. It has been an anchor holding in many investors’ accounts, providing long-term wealth.

Looking ahead, TD Bank looks like it’s in good shape to continue to outperform. TD is well capitalized, diversified, and has a proven track record. In a rising interest rate environment, many stocks typically suffer. There’s a portion of TD’s business that will also get hit, such as mortgages and loans. But there’s a big portion of TD’s business that will benefit. As rates rise, a bank’s interest rate income rises. This is because the rate at which the bank charges for loans rises more than the interest it pays its depositors.

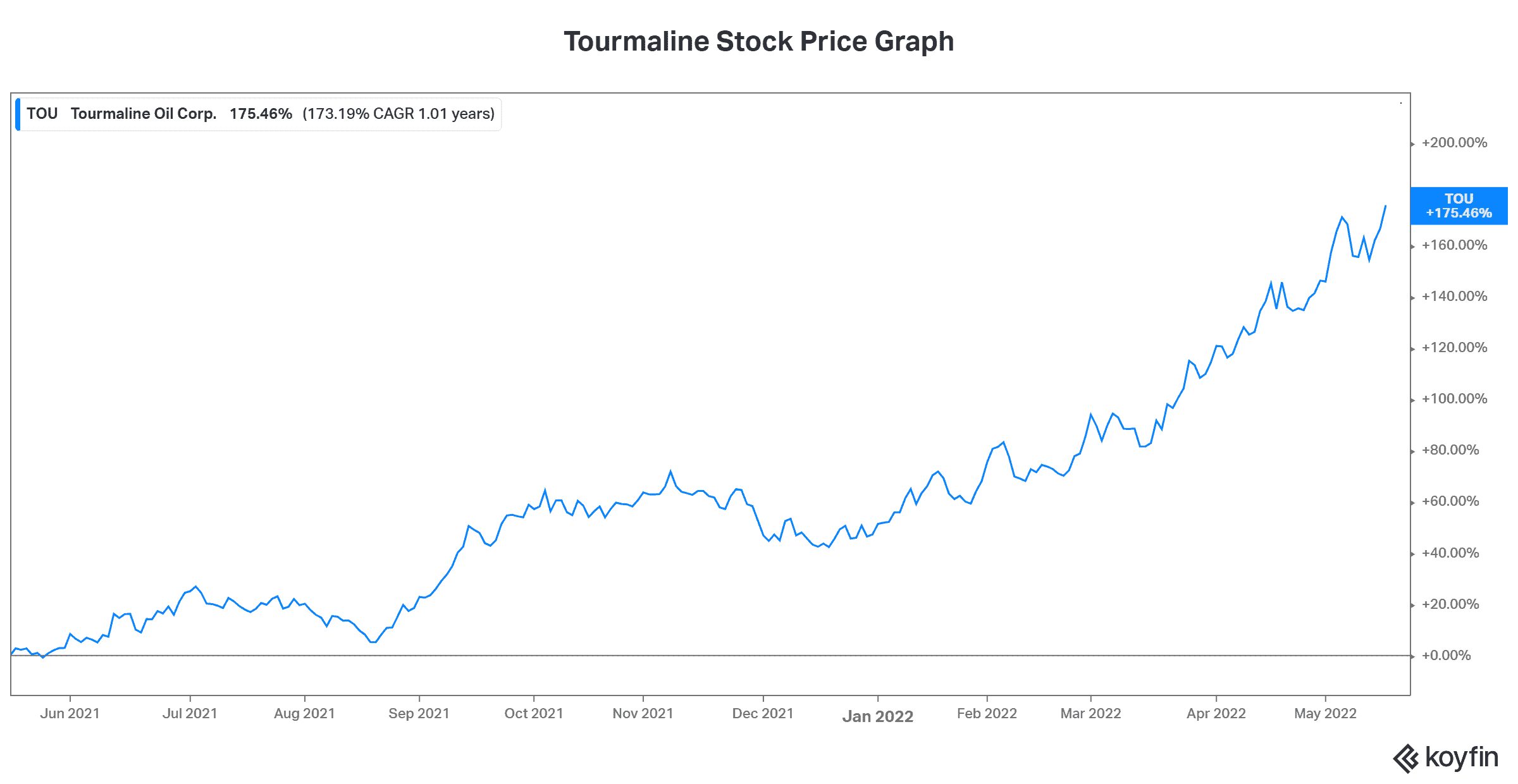

Tourmaline: One of the best dividend stocks in Canada, benefitting from rising natural gas prices

Natural gas prices are on a tear. This is being driven by years of low natural gas prices, which discouraged investment in production. It’s also being driven by soaring global demand. Today, North America in increasingly prepared to supply this insatiable demand. Tourmaline Oil (TSX:TOU) is a is a Canadian mid-tier natural gas producer — the largest natural gas producer in Canada. In fact, it’s looking good in this respect.

Natural gas produced in North America is no longer trapped in North America. There’s been a build out of LNG capacity in the U.S. and exports to high demand areas are accelerating. For example, Asia is a massive source of demand for North American natural gas. While Canada is behind in its LNG build-out, some Canadian companies like Tourmaline are finding their way around this. In fact, Tourmaline recently established a U.S. Gulf coast LNG supply agreement with Cheniere Energy. This terminal will supply to Europe and eventually Asia. As for the medium-term future, Canada is finally stepping up its LNG export capacity, and we should expect to see more growth from this in time.

Cash flows at Tourmaline are booming and the dividend is rising fast. The company is clearly on its own path, quite immune to both rising interest rates and inflation. Its growth drivers are strong and show no signs of abating.