It has been a tough year to invest in Canadian stocks. 2022 is a stark contrast to 2021. Last year, investing seemed so much easier when everything was just going up. This year, investors have to be much pickier. Most sectors (other than energy) are negative this year.

Yet, that is also the opportunity. Stock valuations are rapidly declining, and that makes opportunities for shrewd, long-minded investors. If you have $5,000 and are looking to buy the market decline, here are three stocks I’d consider buying today.

A top dividend stock

If you are looking for a safe haven from inflation, Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is a great stock to put $1,500 to work in. It operates one of the largest diversified portfolios of infrastructure in the world. These are incredibly durable assets that are mostly contracted or regulated.

In a recession, these assets generate stable streams of cash flow. Brookfield can deploy its strong balance sheet into undervalued infrastructure acquisitions.

When the economy is overheated (like it is today), it gets the benefit of higher commodity pricing and more volume. Likewise, nearly three-quarters of its assets have inflation-indexed contracts. Inflation heats up, and so do its earnings.

Brookfield Infrastructure has a long history of raising its distribution annually. This stock pays an attractive 3.5% dividend yield after a recent pullback in its stock price. It looks very attractive today.

A top software pick

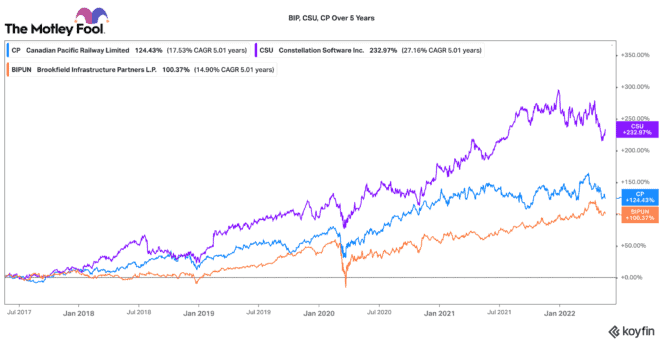

Another stock I am eyeing closely is Constellation Software (TSX:CSU). If you look at its history, this stock rarely corrects. However, when it does, it has always been a great opportunity to buy.

Constellation might be one of the most unique companies in Canada. It acquires and consolidates niche vertical market software businesses across the world. These are very good businesses because they capture high-recurring revenues, yield a lot of spare cash, and are generally essential to their customers. As a result, its business is economically resilient.

It has a de-centralized operational model that essentially allows managers at the business and segment level to make acquisition decisions. Consequently, it can quickly and effectively re-deploy its cash into more acquisitions. This strategy has fueled a 100-bagger return since its initial public offering years ago.

At about $2,000 per share, this stock is never “cheap.” However, given the quality of its business and its opportunity to keep growing, buying even one share could be a great idea today.

A top value stock

Canadian Pacific Railway (TSX:CP)(NYSE:CP) has delivered strong shareholder returns for years. Over the past decade, it has earned a 561% total return for patient investors. That is a compounded annual return of 20%!

I like this stock for several reasons. Firstly, CP operates in a duopoly in Canada. It has a strong defensive operational moat. Chances of new competition are extremely low. Secondly, CP has historically been one of the best and most profitable rail operators in the industry.

Lastly, CP is about to become a North American transport leader. It is hoping to fully integrate Kansas City Southern railroad into its operations by early next year. This is subject to regulatory approval. However, if it is approved it could be transformational to earnings and growth going forward.

CP stock just recently pulled back. The dip looks like a great chance to nab $1,500 worth of shares for the long term.