Often, we don’t want to see the stocks we own fall in value. However, corrections and market crashes can actually be great opportunities to increase our exposure and buy while many of these high-quality stocks are cheap.

After all, diversification is important, but you don’t want to over-diversify your investments. And since we should only buy stocks that are the best of the best, often, those top stocks to buy will be stocks that we already own.

Throughout the pullback this year, I have initiated a few new positions. However, the majority of stocks I’ve bought have been companies I already own that I can add to while they are cheap.

So, if you’re looking to expand your portfolio and find high-quality stocks to buy in this opportune environment, here are two stocks that I own and will buy without question in a market crash.

One of the best green energy stocks to buy if the market crashes

There’s no question that one of the best industries to be invested in for the long haul is green energy. Climate change has been an issue for some time and will take years to slow down and hopefully reverse the effects. In the meantime, that means adding tonnes of renewable energy infrastructure, which gives these stocks a massive runway for growth.

Many renewable energy stocks are worth considering, but one of the very best to buy, which has had strong and impressive growth for years, is Northland Power (TSX:NPI).

What’s particularly attractive about Northland is that it has a tonne of diversification when it comes to its operations. Right now, Northland has assets in North America, South America, Europe, and Asia. In addition, its assets are also well diversified with onshore and offshore wind, solar, and even a utility business.

This makes Northland an excellent long-term investment, because it offers an attractive mix of both growth potential and reliability. On top of the 2.6 gigawatts of net operating capacity that Northland has, it also has another two gigawatts of operating capacity in construction or advanced development.

And because the cash flow it receives is so robust, it also returns cash to investors with a dividend that currently provides a yield of roughly 2.9%.

So, should this top green energy stock ever sell off significantly in a stock market crash, there’s no question that it’s one of the first stocks I’d look at buying more of.

One of the best long-term real estate stocks to buy and hold

In addition to Northland, another incredible long-term investment to take advantage of when it’s cheap and buy in a market crash is InterRent REIT (TSX:IIP.UN).

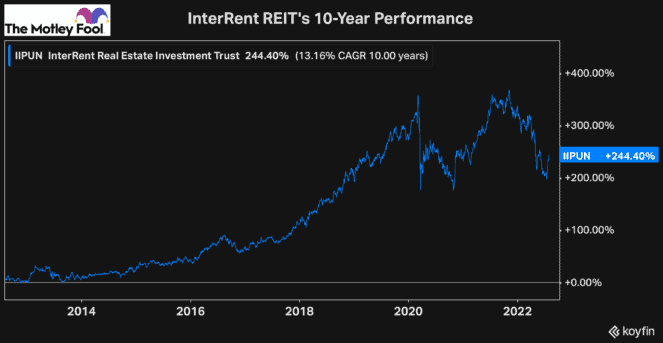

InterRent is a residential real estate stock that’s main focus is to grow investors’ capital as quickly as possible. For that reason, it returns less cash than most of its peers. However, the growth it’s achieved over the last decade is impressive.

As you can see above, even with the significant selloff lately, InterRent has grown investors’ capital at a compound annual growth rate of over 13% for a decade now. That’s due to the strong and consistent growth in its operations. From 2011 to 2021, InterRent increased its annual revenue from just $38.5 million to $185 million — an increase of over 380%.

So, while high-quality stocks like InterRent trade cheaply, it’s a significant opportunity for investors to buy. And, as you can see by the chart, the stock has already pulled back significantly and does offer value today.

However, if it were to sell off even further in a market crash, there’s no question it would be one of the best stocks you could buy and certainly one of the first I’d look to increase my position in.