Canadians all need some monthly income right now, and though inflation is up, these cheap and safe stocks remain down. So, now is the time to lock in some passive income before it’s gone.

An energy stock that keeps climbing

Pembina Pipeline (TSX:PPL)(NYSE:PBA) shares continue to climb during this time of high oil prices. But that’s not the only thing that investors should be interested in. Motley Fool investors may have noticed that Pembina stock recently upped its dividend, and now offers a yield of 5.5% as of writing.

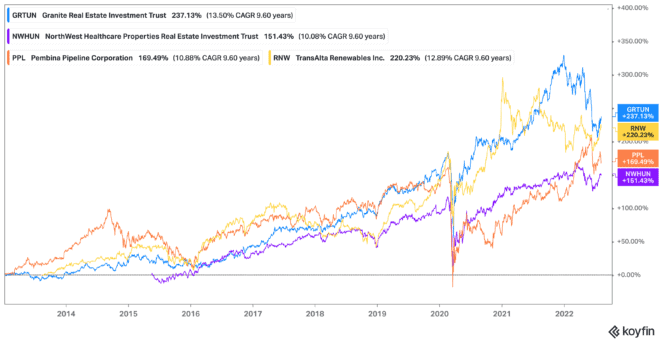

That’s on top of stellar growth for the monthly passive-income stock. Pembina currently offers a compound annual growth rate (CAGR) of 4.91% over the last decade. As for its shares, those are up by a CAGR of 11.55% in the same time. And, frankly, it offers Motley Fool investors a far safer and steadier climb than many other energy stocks.

The company recently upgraded its guidance for the year after a strong second quarter. It delivered earnings of $418 million and now aims for adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) between $3.575 and $3.675 billion. And, trading at 1.76 times book value, it’s a cheap stock to pick up today.

Not the only energy stock out there

If you’re planning on holding for the future, then I would consider TransAlta Renewables (TSX:RNW) as well for a monthly passive-income stock. It’s a cheap stock with shares still down from 52-week highs, trading at 2.46 times book value. It currently offers a dividend yield of 5.21%, so it’s definitely nothing to slouch at either.

The renewable energy company has seen its dividend grow every so often, creating a CAGR of 5.2% over the last decade. Plus, shares are climbing higher and higher in this clean energy-focused future. Shares are up 221% since coming on the market — a CAGR of 13.84% as of writing.

And TransAlta is also coming off the back of solid earnings, purchasing more facilities and announcing adjusted EBITDA of 126%, up 30% year over year, and free cash flow of $87 million, up 23%. That’s security that Motley Fool investors could certainly use while earning passive income.

A necessary and cheap stock

I say this stock is necessary because NorthWest Healthcare Properties REIT (TSX:NWH.UN) provides necessary real estate within the healthcare sector. This is only growing in need, and, therefore, the company has only been growing to meet demand. That is what makes it such a safe earner of passive income.

The company currently offers a dividend yield of 6.14%, but it hasn’t grown that dividend in some time. Still, shares make up for it, as they’re up 151% since coming on the market — a CAGR of 13.59%.

Not only does NorthWest offer stable monthly passive income, it’s growing that income thanks to finding new acquisition opportunities. It now spans from Australia to the United States and into Europe. And all while trading at an incredibly cheap 7.25 times earnings.

Get in on industry

Industrial properties are another real estate investment that I would recommend. But of the best companies out there, Granite REIT (TSX:GRT.UN) has to be at the top. The company trades at an incredibly cheap 3.42 times earnings, with analysts expecting that to rise when consumers start spending and the need for e-commerce rises again.

For now, though, you can grab onto the company’s 3.87% dividend yield for passive income — one that’s grown at a CAGR of about 3.96% as of writing. As for shares, those are up by a CAGR of 13.5% in the last decade. The company’s last quarter was incredible, closing $193.6 million in acquisitions, and with net operating income and funds from operations both rising year over year.

Another earnings report is coming around the corner, so it’s a great time to consider the cheap stock before another boost.