The TSX is on a volatile path, with many stocks down big. This has given rise to some very interesting value stocks to buy now. While the next few months will likely continue to be volatile, at least these stocks don’t have frothy valuations. Expectations are low, but the potential is high.

Without further ado, here are the two of the best value stocks to buy right now for outsized returns.

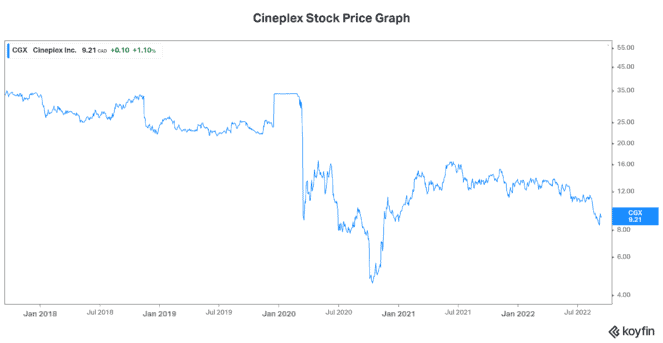

Cineplex stock: A value and contrarian play

What can I say about Cineplex (TSX:CGX)? As I see it, investors have mistakenly lost faith in the movie exhibition industry and Cineplex. I’ve come to this conclusion largely because of the strong recovery in box office numbers in 2022. In April, the North American box office was reeling in 56% of 2019 levels. By July, it had grown to 85% of 2019 levels. This is significant, and it reflects the strong consumer appetite for movie theatre showings.

No discussion of Cineplex would be complete without mentioning the elephant in the room: streaming. Even before the pandemic, streaming was gaining traction. It left many with the firm belief that the movie theatre business is on the road to nowhere. Thankfully, Cineplex saw this threat years ago and began addressing it. It’s part of what makes Cineplex one the of best stocks to buy right now.

The value case for Cineplex

Once upon a time, Cineplex was merely a movie exhibition company. Today, it’s a media company with an increasingly diversified business. Cineplex has added amusement (gaming) venues, a media division, and other revenue-generating segments, such as Cineplex Store. The bottom line is that 30% of Cineplex’s revenue is not related to the movie exhibition business. This is all good stuff, as it leaves the company less vulnerable to the streaming threat. It also exposes it to other growth businesses.

As both a value stock and a contrarian stock, Cineplex is a very interesting play with significant upside. The stock has dipped below $10 into deep-value territory. In fact, it trades a price-to-earnings ratio of a mere nine times next year’s expected earnings.

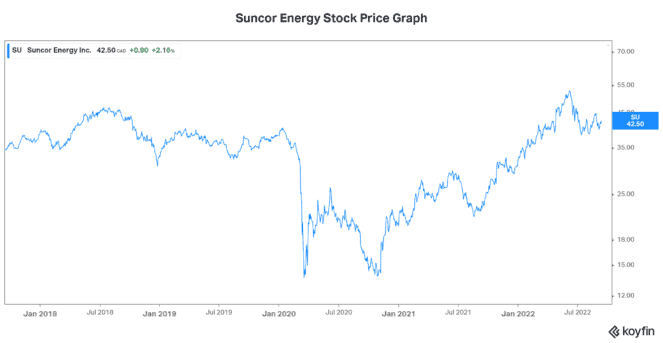

Suncor Energy stock: This value stock is down but not out

Like it or not, but Suncor Energy (TSX:SU)(NYSE:SU) is Canada’s leading integrated oil and gas company. It was once an “investor darling” that could do no wrong, but things are very different today. Confidence in Suncor has plummeted, along with its share price and valuation.

This is where value investors usually step in. What we must do now is evaluate Suncor to determine if its recent setback will pass. So, what happened to cause Suncor stock to plummet 20% from its 2022 highs?

Safety issues are a human and moral problem. They go far beyond numbers, shareholder value, and profits. Safety must come first at all times. This is why Suncor’s recent safety record is so disheartening. We thought Suncor was a leading example of a fine Canadian company, until a death occurred at one of Suncor’s mines, and people started digging a little more.

Since 2014, Suncor has had 12 workplace deaths. According to activist investor Elliot Investment Management, this is more than all of Suncor’s peers combined. In the last five years, Suncor’s dividend has grown by almost 50%. Its operating cash flows have soared 30%. Yet Suncor has seen its stock price rise only 14%. Clearly, there’s a big problem here that’s not being reflected in the numbers. Now that the curtain has been lifted, is there any going back to what once was?

The value case for Suncor

Management at Suncor has been replaced and promises are being made. According to Suncor, things will get better. This dismal safety record will be addressed, and it will be put right. If this happens, which I think it will, it will be the catalyst for Suncor stock. Oil and gas fundamentals are still positive; Suncor now has to redeem itself for this to be reflected in its share price.

Suncor trades at a mere six times earnings. It also trades at only 1.5 times book value, yet its return on equity is an impressive 25%. The bottom line is that Suncor stock is a steal. It’s also one of the best value stocks to buy right now.