There are a lot of growth stocks out there to consider on the TSX today, but not all of them are winners. In fact, while I’d look at some growth stocks because they’re up year to date, others are down. But I’d still consider them growth stocks based on their future performance.

Today, I’m going to offer investors a bit of each, so that beginner investors can feel safe knowing they can buy these three growth stocks and see secure share growth in the years to come.

Canadian Utilities

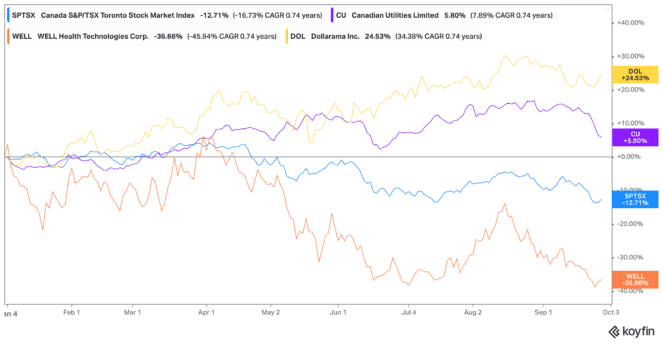

I would consider Canadian Utilities (TSX:CU) a growth stock because it has actually risen this year while the TSX drops. The TSX today is down 12.7%, but Canadian Utilities stock is up by about 5.5%. Although it has definitely dipped in the last while, that makes now the perfect time to pick it up.

Utilities in general are great to have in your portfolio as they provide secure share growth. This comes from companies like Canadian Utilities creating steady revenue that won’t disappear even during a downturn. This consistent performance has allowed the stock to become the only Dividend King on the TSX today.

You can now lock in Canadian Utilities stock at a deal trading at 18.1 times earnings, with a 4.5% dividend yield as of writing.

WELL Health

WELL Health Technologies (TSX:WELL) was a growth stock that soared high, and fell lower. Shares climbed during the pandemic as WELL stock marketed and expanded its telehealth offerings. But when a vaccination came around, people dropped the stock in droves.

Yet there really wasn’t a reason to do jump from a moving ship! WELL stock has become the largest outpatient clinic in Canada. It has expanded into the United States and now creates record revenue quarter after quarter. And yet it’s still down by about 37% year to date. Given that telehealth won’t be going anywhere and the excitement has passed, now is the time to pick up this stock at ultra-low prices.

You can pick up WELL stock trading at just 1.04 times book value. Plus even with the share loss, it would take just 47.9% of its equity to cover its total debts. Now that’s a strong stock.

Dollarama

The growth stock that’s probably doing the best right now is Dollarama (TSX:DOL). Dollarama stock is a great option during a downturn, but honestly it’s a great option any time. During a downturn, there is an influx of consumers looking for cheap products. But even during good times, Dollarama stock is able to grow through opening more locations and making strong acquisitions.

This expansion has been ongoing for years, and Dollarama stock continues to see massive growth and bring in more top-end brands. All for under $4 in store. With the pandemic restrictions lifted, its year-over-year growth has been insane. And that’s likely to continue, at least for the near future.

Shares of Dollarama stock are up 25% year to date, and 2,466% in the last two decades!

Bottom line

These three growth stocks are solid choices for those thinking long-term into the future. Each provides you with secure income from their revenue sources, and have been expanding at a consistent rate. So make sure you pick these up before the market turns around.