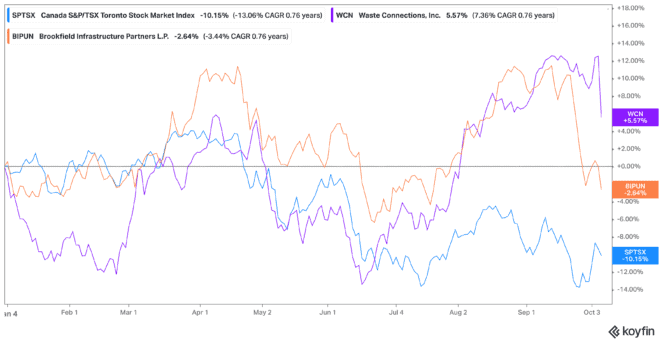

TSX stocks remain down by 10.15% year-to-date as of this writing. After a small surge in prices, stocks fell once again well into correction territory. It can be a scary time to consider investing, but I sincerely urge you to do so if you’re able.

However, I’m not saying you should put everything you have into stock investing right now. There are a few reasons for that, so let me get into them.

Don’t drop it all at once

The first reason I wouldn’t recommend putting all of your investing money into the market at once is safety. You want some cash on hand in case inflation continues to rise. In fact, you should keep an emergency account. This is an account that has about three-months’ worth of wages in it, just in case you lose your job, you end up in the hospital, or encounter another emergency situation.

But another less scary reason for not investing all at once is that you miss out on future opportunities! Practically no one can predict the market bottom. Because of this, it’s far better to get in on the dips, and then get in again when TSX stocks dip even more. By drip-feeding into the market, you stand a far better chance of coming out the other end well into the black.

A good starting point

Let’s say you have $6,000 that you want to invest throughout the year. Right now, I’d recommend starting with no more than $1,000 of that. That way, you still have $5,000 to use through the rest of this downturn to drip-feed the market. So where on earth should you put that cash today?

If you want stability and a likely rebound during this downturn, I’d look for TSX stocks in the infrastructure sector. Services offered by companies in this sector are necessary no matter what happens, and cash will continue to flow in. That’s thanks in part to long-term contracts that keep these companies afloat.

Which infrastructure related TSX stocks should you consider? That depends on how much risk you want to take on. If you want to get specific, Waste Connections (TSX:WCN)(NYSE:WCN) is a strong choice because it provides essential services that we will always need plus it has a continental portfolio.

WCN is a leader in delivering non-hazardous waste collection, transfer, disposal, and recycling services in the U.S. and Canada. It’s considered a wide-moat stock which will help it maintain a competitive advantage for years to come. Believe it or not, disposing of waste is a complex business with serious barriers to entry, limiting competition in the market. Shares of WCN are currently up by 6.2% year-to-date. But keep in mind that it’s not a foolproof bet as it’s still subject to contract negotiations, strikes, and other issues.

Another option is Brookfield Infrastructure Partners LP (TSX:BIP.UN)(NYSE:BIP), which owns infrastructure assets worldwide. It’s a long-term growth stock that’s incredibly defensive. This is a more conservative and diversified option, stemming from a focus on energy and utilities, something the world needs no matter what the market is doing. In addition to owning a tonne of utility assets, the company is heavily invested in transportation, midstream energy, and data infrastructure, all of which supply essential services.

Diversification is further reinforced by the fact that BIP owns high-quality infrastructure assets all over the globe. The company is constantly looking to buy assets that it believes are undervalued or underutilized. Over time, as BIP improves the cash flow that these assets generate, it can sell them and recycle the capital into new opportunities.

Plus, the dividend yield of 3.93% is ultra-high right now. The only downside is there’s been a recent drop and shares are down by 2% year-to-date.

Bottom line

Even with recent drops, these two TSX stocks are the perfect choice for long-term investors looking for drip-feeding opportunities. So, if you have just $1,000 that you’d like to safely invest today, Brookfield and Waste Connections are the two stocks I’d consider.