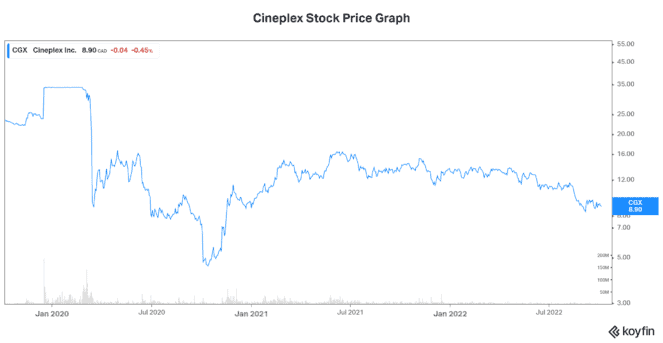

Love it or hate it, Cineplex Inc. (TSX:CGX) is Canada’s largest movie exhibition company, with a market share of approximately 80%. Cineplex stock has been hit hard in the last few years. But today, the pandemic has faded into the background and things are getting back to normal. Yet, Cineplex stock price is still falling – a fact that has made CGX stock super cheap and me more bullish than ever.

I realize it’s a big risk that I’m taking here. I’ve been following Cineplex’s stock price all the way down, insisting that this company will thrive – insisting that its business won’t be destroyed by streaming. Today, I’d like to put this to the test.

Post-pandemic movie theatre attendance is strong

It’s true that the pandemic shutdowns really tested the likes of Cineplex. Resulting losses were massive, and the company scrambled to minimize the bleeding. But through all of this, the government, the banks, and even landlords, made concessions. In the end, Cineplex survived. And although it has not fully recovered, there are many indications that it will thrive once again.

I would like to offer a few tidbits of information to back up this claim. In July of this year, box office revenues were 85% that of July 2019. Also, September 3rd was the busiest day so far in 2022 for Cineplex – and the third busiest in the last five years.

Paying more for a movie experience at Cineplex

Cineplex has achieved great success in transforming the business – effectively tapping into movie-goers’ appetite for a premium experience. These experiences can’t be replicated at home – and they’ve been commanding higher ticket prices. So far, movie goers seem comfortable with this. For example, Cineplex’s VIP ticket price of $19.99 is more than 50% higher than the regular ticket.

Expensive for a movie? Maybe. But not expensive if we compare it to other forms of entertainment, such as live theatre, or dinner at a fancy restaurant.

What could go wrong? The possible headwind of today’s climbing inflation. Also, if we go into a recession, that might put a damper on Cineplex’s revenue. Will people spend less on entertainment in these situations? Maybe, but as a rebuke, I tend to look past recessions.

It seems that movies are a great escape, so people tend to reserve money for this form of entertainment even in hard times. And as I mentioned, it’s a cheaper escape than some alternatives. In hard times, it’s more likely that people will cancel travel plans that take a bigger bite out of the wallet, rather than cancel a night out at the show.

Cineplex is not a one-trick pony

Moving on from the movie exhibition business, other segments account for roughly 30% of Cineplex’s revenue. These are segments that are unrelated to the movie theatre business. As such, they provide valuable diversification. Foresight is what brought Cineplex into these businesses, as the company saw the writing on the wall many years ago.

For example, management got into the amusement and leisure space. This segment boasts amusement/gaming venues that are benefitting from the massive gaming industry market. The bottom line here is that Cineplex is a nicely diversified entertainment company that has multiple opportunities for growth.

Motley Fool: the bottom line

In conclusion, I would like to draw your attention to Cineplex stock’s valuation. It’s just so dirt-cheap right now, trading at 0.5 times sales and a mere 5.1 times cash flow. In my opinion, this reflects overly pessimistic views that are bracing for a disaster situation. But the numbers, as discussed, simply don’t back this up.