Suncor Energy Inc. (TSX:SU) is Canada’s largest integrated energy company. It boasts world class assets and operations, and it’s been a reliable energy stock throughout its history. Suncor’s third quarter results boasted $4.5 billion in adjusted funds flow from operations. In short, SU stock is one of the most attractive energy stocks on the TSX.

What’s behind Suncor’s performance? Please read on as I share with you the three most important factors to keep in mind about Suncor stock.

Suncor’s integrated model yields strong benefits

This energy giant operates as an integrated energy company. What this means is that it operates two different segments, the upstream segment and downstream segment. In other words, the impact on the company from deteriorating fundamentals in one area of the oil market is mitigated. Let me explain.

The upstream segment is the segment that explores for and produces oil and gas. This segment benefits directly from rising oil and gas prices. The downstream segment, or the refining and marketing segment, has slightly different economics. This segment’s fortunes are a function of the crack spread – the difference between the cost of a barrel of crude oil and the final petroleum products like gasoline or fuel oil.

In Suncor’s Q3 results, we saw the benefits of this diverse business model in action. Suncor’ exploration segment was hit by a higher discount for heavy oil. But on the flip side, its downstream segment benefitted from this, as this segment is a buyer of heavy oil. This translated into strong refining margins for Suncor.

Suncor stock on the TSX is unjustifiably cheap – and ready to spike higher

This one is big. Did you know that SU stock on the TSX is trading at a mere 5.5 times this year’s expected earnings? This compares to an industry average of closer to nine times. This valuation exists despite the fact that Suncor is one of the industry leaders in profitability and returns generated.

So why is this the case? Well, first safety issues were the concern – a very valid concern that hit Suncor’s stock price. Then, the company’s operational performance came into question. Today, Suncor is addressing both of these issues very effectively, in my view.

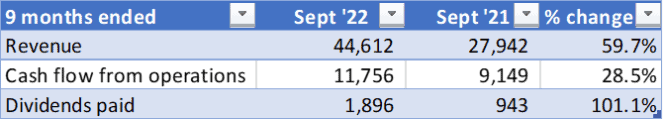

There was a ton of good news in Suncor’s Q3. Earnings came in above expectations, more than doubling to $1.88 per share. Also, adjusted funds flow for operations increased more than 70% to $4.5 billion. Furthermore, production was up big and refinery utilization was 100%.

All of this speaks to a very sound business that’s thriving.

A plan to address old problems will create safer, more efficient operations

On to the final and a point of contention for Suncor stock – the company’s safety performance is in dire need of improvement. So, the company has brought in new management and new ways of doing things. The effort is strong, and it’s already yielding results.

So, Suncor is installing state-of-the-art technology to improve safety. For example, the company is installing industry-leading technology on collision awareness to mitigate the risks. And this plan has been fast moving, with significant progress already made. Two thirds of the Syncrude Aurora mine will have this technology installed by the end of this year. Suncor will complete the remaining installations by January 2023. Also, Suncor is installing fatigue management systems, and these will be completed by early 2023. These systems have been shown to reduce fatigue-related events by up to 80%.

Motley Fool: The bottom line

I think that the most important things to know after Suncor’s earnings are what’s been dragging the stock down recently. The first is its performance, which this quarter has shown us is improving. The next thing is Suncor’s safety record, which the company has shown it’s addressing with actionable plans to improve. And the last is that Suncor’s (SU) TSX stock price and valuation will not be this cheap for long, as this third quarter update is signaling to us.