There is a silver lining when markets are declining. If we can remain level-headed, that is. You see, a declining Canadian stock market uncovers a lot of value, as all stocks, good and bad, are taken down. This is the opportunity.

In this article, I’ll discuss three value stocks that we can buy at a discount today.

Enbridge

As far as value stocks go, Enbridge Inc. (TSX:ENB) leads the list. With 29 consecutive years of dividend increases, Enbridge is a prime example of a Canadian stock to buy in a declining market. Its predictable and defensive business can give us great confidence in Enbridge stock.

Enbridge recently updated investors on the state of its business and guidance for 2024. EBITDA is expected to increase approximately 4%, to between $16.6 and $17.2 billion. As Enbridge’s CEO stated, this update reflects the “predictability and strength of our four core businesses”.

Moreover, the company announced another increase to its dividend. The 3% increase will bring Enbridge’s annual dividend to $3.66, and its yield to a very generous 7.66%.

Yet, Enbridge stock is down more than 12% so far this year. It currently trades at 17 times 2024’s expected earnings, which I believe reflects a discount to the value of the company.

Suncor Energy

The next stock I’d like to highlight here is Suncor Energy Inc. (TSX:SU). Suncor is an integrated oil and gas company. This means that it has both upstream and downstream operations such as oil sands production as well as refining, or upgrading assets. This business model has afforded Suncor with the benefits of diversification – generating strong and stable financial results over the long term.

A company that generates strong long-term results is a good company to buy in a declining market, because it has proven that it can be resilient and withstand the pressure. Suncor’s business model does just that. Its stable and steady stock price performance over the long-term displays this.

Similar to Enbridge, Suncor has also recently increased its dividend. As CEO Rich Kruger stated, “the increase is supported by our improved operational performance … “. This 5% increase brings Suncor’s dividend yield to 5%, and it follows a long history of dividend increases.

Suncor stock is cheap at this time, trading at a mere 7 times 2024 expected earnings. This actually makes it a highly discounted Canadian stock. This valuation is a function of the market but also the fact that Suncor has been dogged by different issues such as safety and operational issues. Yet, Suncor stock is likely on the road to recovery as its new CEO has been taking action.

One example is Suncor’s acquisition of TotalEnergy’s Canadian operations. This acquisition includes Total’s remaining interest in the Fort Hills oil sands project as well as in the Surmont in situ asset. It effectively makes Suncor the sole owner of Fort Hills, and this brings with it many advantages.

Cineplex

The last discounted Canadian stock that I’d like to discuss is Cineplex Inc. (TSX:CGX). We all know Cineplex as Canada’s leading movie exhibition company. But it has become so much more over the years, with amusement, media, and digital media businesses that have diversified the company’s revenue.

Today, Cineplex stock remains highly discounted, in my view. It’s one that I have written about before, and one that I continue to like. In essence, the business is recovering really strongly after the hit of the pandemic years.

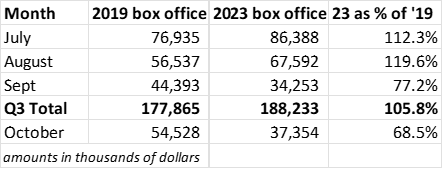

This can be seen in its latest results, where revenue increased 36%, and was 113% of 2019 levels. Also, adjusted EBITDaL (earnings before interest, taxes, depreciation, amortization, and special losses) increased 307%, and was 135% of 2019 levels. On the last trading day of 2019, Cineplex stock was trading at $34. Today, it’s trading at approximately $8.30.