Have you ever felt caught in the “consumption trap?” It’s a cycle where you sell your time and labour for a wage, spend beyond your means, and then find yourself working even harder to pay off debts—essentially making bankers rich instead of yourself. But what if there was a way to break free?

Imagine using your hard-earned money to buy productive assets like stocks, holding them in a tax-sheltered account like a Tax-Free Savings Account (TFSA), and then using the dividends from these investments to cover your everyday expenses.

This approach isn’t just about saving money; it’s about making your money work for you, generating income that makes life a little easier without the extra hustle. Here’s how you can start building that $250 per month in tax-free passive income.

The ETF to buy

If I were investing in a TFSA for passive income, I’d skip picking single dividend stocks. Instead, I’d aim for a diversified portfolio via an exchange-traded fund (ETF), which offers broader exposure at a lower cost.

My top pick for today is Vanguard FTSE Canadian High Dividend Yield Index ETF (TSX:VDY).

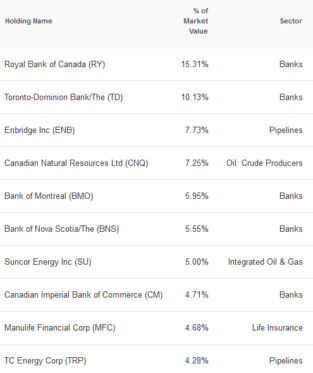

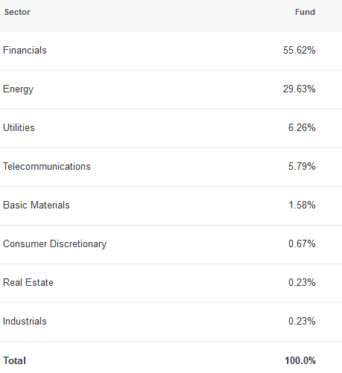

This ETF includes 56 stocks chosen from the broader FTSE Canada All Cap Index based on their high forecasted yields. In fact, you likely own some of VDY’s top holdings already!

You’ll mostly find sectors like banks, energy, utilities, and telecoms represented in this fund—these comprise Canada’s major dividend-paying sectors.

Together, they average a solid 4.45% annualized yield with monthly distributions, all for a reasonable expense ratio of just 0.22%.

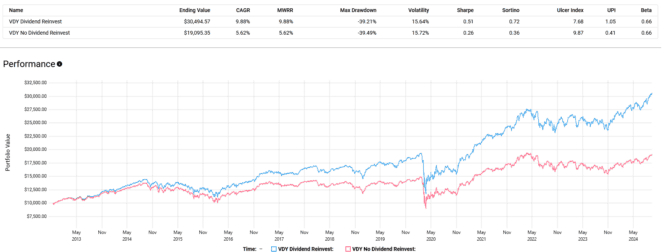

From November 2012 to present, VDY has returned an annualized 9.88% with dividends reinvested. But even if you withdrew the dividends and spent them, the ETF’s share price has compounded at an annualized 5.62% alone!

How much do you need to invest?

Assuming VDY’s most recent August monthly distribution of $0.194448 and the current share price at the time of writing of $46.86 remained consistent moving forward, an investor using a TFSA would need to buy roughly $60,262 worth of VDY, corresponding to 1,286 shares to receive around $250 monthly tax-free.

| ETF | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| VDY | $46.86 | 1,286 | $0.194448 | $250.06 | Monthly |