If I went to prison and the last thing I could do before getting locked up was set my accounts to autopilot, I’d want just a few things taken care of.

First, I’d want true diversification: exposure to stocks, bonds, and maybe even some commodities. Second, I’d want a rules-based strategy that didn’t require me to check in. And third, I’d want a little bit of leverage. If I’m serving time, I’m not going to be too worried about short-term market volatility.

For that role, I’m picking Hamilton Enhanced Mixed Asset ETF (TSX:MIX). Here’s why I’d choose MIX over your typical vanilla asset-allocation exchange-traded fund (ETF) from Vanguard or iShares.

It’s diversified across stocks, treasuries, and gold

The beauty of MIX is that it blends three fundamentally different sources of return in one package.

Stocks, specifically the S&P 500, represent long-term business growth and profit. You’re betting on human ingenuity, productivity, and capitalism. Historically, this has been the engine of wealth creation.

Then, there are long-term U.S. Treasury bonds. These shine in different conditions, usually when growth slows and inflation expectations drop. They’re not just income-generating assets. They tend to rally when stocks fall, especially in recessions, making them a classic risk-off hedge.

Finally, you’ve got gold. Unlike stocks or bonds, it doesn’t generate income, but it tends to hold value during inflationary periods or when there’s major geopolitical uncertainty. Think of it as insurance against chaos.

Right now, MIX is the only ETF in Canada that puts all three together in a meaningful way: 60% S&P 500 exposure, 20% long-duration U.S. Treasuries, and 20% gold bullion. Each piece is there for a reason, and together, they cover a wide range of macro outcomes.

It applies leverage smartly

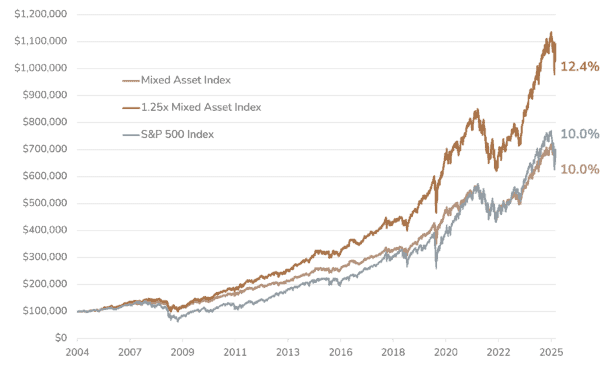

Plenty of ETFs in Canada use leverage to try and boost returns—sometimes cranking it up to two or even three. That might work for day trading, but it’s way too aggressive for long-term investors. MIX, however, uses a modest 1.25 times leverage, and it does so in a way that actually makes sense.

Let’s say you invest $100. Normally, that would give you $60 in stocks, $20 in long-term U.S. Treasury bonds, and $20 in gold. But because MIX uses 1.25 times leverage, your actual exposure becomes $125. That breaks down to about $75 in stocks, $25 in bonds, and $25 in gold.

So, rather than just magnifying one asset class, MIX boosts all three in balance. This lets you potentially earn stock-like returns, maybe even better, while holding a mix (pun intended) of assets that don’t always move in the same direction.

That’s what makes the leverage smart. It’s not about chasing big wins. It’s about squeezing more out of a diversified portfolio without taking on unnecessary risk via over-weighting a single asset.

It’s designed to be affordable

This kind of strategy isn’t new in investing circles, but until now, it’s mostly been reserved for high-net-worth investors or expensive mutual funds with steep management fees.

MIX changes that. Hamilton is putting its money where its mouth is, charging a 0% management fee until April 30, 2026. After that, it’ll be a still-reasonable 0.35%.

The ETF also uses low-cost index ETFs for its underlying holdings. That means while there is some layering of fees since you’re holding ETFs inside an ETF, Hamilton has clearly made an effort to keep costs down by choosing economical building blocks.

Just keep in mind that the fund’s official MER (management expense ratio) won’t be available until a year after launch. When it is, expect it to be higher than advertised, not because of hidden fees but due to the cost of borrowing. MIX uses leverage, and interest expenses from that leverage get factored into the MER.

That said, it’s no different from you borrowing on margin to gain extra exposure, except Hamilton does it for you, likely at better rates, thanks to institutional access.