Canada’s primary stock market benchmark, the S&P/TSX Composite Index, has done wonders so far this year: it’s soared past prior record levels, rising over 21% year to date to touch 30,000. If you’ve got some cash on the sidelines, you might be feeling a mix of excitement and nervousness in October. It’s natural to wonder if putting new money to work now is like buying at the top. But what if I prove to you that investing at all-time highs isn’t a trap? In fact, it’s often the most rewarding path forward for those with a long-term investment horizon.

The TSX is meant to keep rising

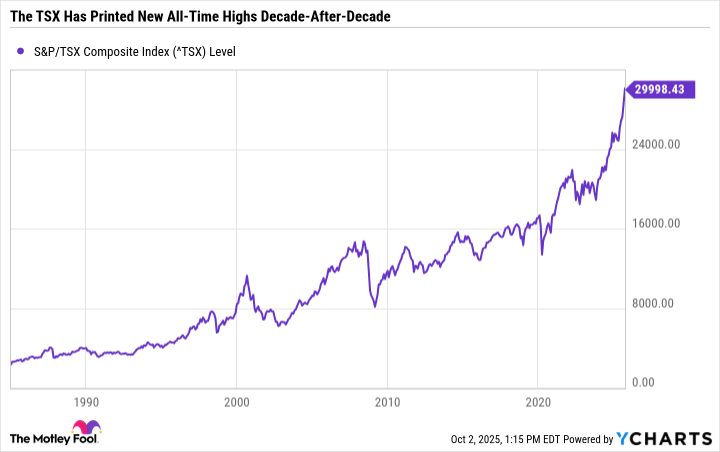

Let’s get one thing straight: markets are naturally designed to reach new peaks. Since the TSX’s inception, it has consistently charted a path upward over the long run. This isn’t magic. It’s a result of economic growth, corporate profits expansion, and the collective increase in Canada’s national wealth.

A look at a 30-year chart of the TSX shows a line that wobbles but ultimately trends definitively higher. Waiting for a dip that may never arrive within your investment time horizon is a classic misstep.

By the time a significant downturn occurs, the market might already be far above today’s levels, making your current “all-time high” look like a bargain in hindsight. The real risk isn’t buying at market highs; it’s not buying at all and watching your capital’s purchasing power get slowly eroded by persistent (and natural) inflation.

Seek out the market’s bargains

How do you dive in with new capital when everything looks expensive? The key is to look beneath the surface. The TSX’s impressive rally in 2025 has been heavily fueled by the meteoric rise of metals and mining stocks, with giants like Barrick Mining and Kinross Gold stock posting staggering gains as gold prices hit records. The S&P/TSX Capped Gold Index has posted a 107% year-to-date gain as gold (and silver) printed new highs this year. While these stocks may be pricey now, other areas have been left in the dust. This is where opportunity lies.

Canadian real estate investment trusts (REITs), for instance, have been relative laggards. Their distribution yields remain particularly attractive for passive-income purposes. Similarly, the industrials sector has felt the sting of geopolitical headwinds and has underperformed the broader market. The S&P/TSX Capped Industrials Index is up 3.9% over the first three quarters of 2025.

These sectors haven’t had their moment in the sun this year, but for forward-looking investors, that’s precisely what makes them interesting today. Their time to catch up will come. They could be ready for new money.

Consider a tactical shift: Sector rotation

If you’ve already ridden the wave with high-flying Canadian stocks this year, October could be an excellent time to think about a sector rotation. This simply means taking some profits from your winners and reinvesting them into areas that possess strong fundamentals but haven’t yet participated fully in the rally.

For example, the TSX communication services sector is still down 13.8% over the past 12 months, despite a modest gain this year. The capped real estate and industrials indices have also posted single-digit gains, lagging far behind the overall market. By rotating into these underperformers, you position your portfolio for potential future gains when the market’s momentum eventually shifts.

Go on a treasure hunt for hidden gems

Canadian investors with the time and inclination could go on the most rewarding strategy: old-fashioned stock picking.

This strategy involves digging into a company’s financials, evaluating its price-to-earnings ratio, which compares its share price to its per-share profits, or its earnings before interest, taxes, depreciation, and amortization, a measure of core profitability, among other fundamental valuation metrics.

The goal is to find fantastic businesses whose current stock prices don’t reflect their underlying strength and growth potential. Recently, beaten-down growth stocks like Constellation Software and MDA Space have historically been examples of such long-term winners.

If you lack the time for deep research, consider joining a community of like-minded investors. The principle remains the same: focus on great businesses, not on guessing the market’s next move. As the legendary Warren Buffett advises, the goal isn’t to time the market, but to spend time in the market.

The Foolish bottom line

The TSX at an all-time high isn’t a stop sign; it’s only a milestone. By focusing on undervalued sectors, considering strategic rotations, and hunting for individual stocks with a disconnect between price and value, you can confidently continue your investing journey.