Investing in stocks that are benefiting from strong secular growth trends will allow you to generate strong, consistent returns over time. However, it’s important to identify those trends that have staying power, which will support long-term growth and value creation.

Last week, Aecon Group Inc. (TSX:ARE) stock soared as the company reported another record quarter. The stock is 94% higher than its 2025 lows and more than 200% higher than three years ago. This, as demand continues to soar and backlog hit $10.8 billion, us the highest level ever.

In this article, I’ll highlight why it’s not too late to buy Aecon stock despite its strong performance in the last few years.

Record results

Aecon’s recent third-quarter results were filled with positive buy signals and bullish trends. Simply put, infrastructure spending is booming. For example, the nuclear sector is ramping up, driven by renewed interest in the clean properties of nuclear energy. This is driving increased spending on new plants and refurbishments.

Other sectors that are seeing strong volumes include the utility and gas distribution sectors. This growth is being driven by the fact that more than 40% of utility infrastructure is at the end of life. It’s also being driven by the demand from electrification, artificial intelligence (AI) factories, and data centres. Adjusting and expanding infrastructure to meet this demand is essential.

As a result, Aecon’s third-quarter revenue came in at $1.5 billion, 20% higher than the same period last year. And of course, backlog stands at record levels of $10.8 billion.

Aecon’s outlook

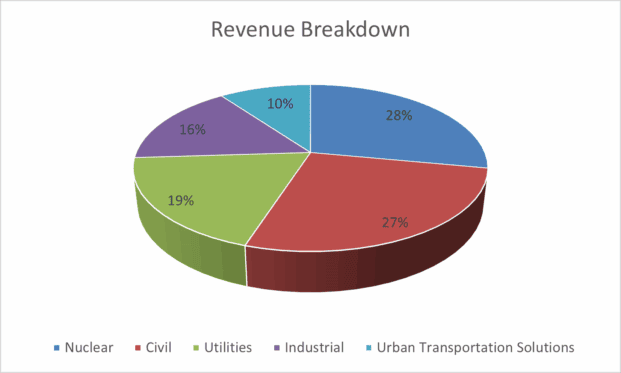

The company has a diversified mix of projects by geography, sector, contract size, and type. Please see the graph below for the breakdown of Aecon’s revenue in its latest quarter.

In Aecon, we have a stock that’s benefiting from strong secular growth trends across a diversified set of industries. According to management, the company’s pipeline is strong in Canada, with a little more than $100 billion in projects expected in the next five years. Aecon won’t get all of this work, of course, but it is a contractor of choice, with a leading and growing position in the industry.

Looking ahead, we can also expect Aecon to continue to capitalize on growing nuclear projects in the US. In fact, Aecon is growing its capacity in the US nuclear sector and is now in 15 states, with more than 1,300 people.

Attractive valuation

Checking in on Aecon’s valuation, we can see that the stock is still trading at very reasonable levels – 18 times next year’s earnings and 14 times 2027 consensus earnings. Given the long-term growth outlook of the company’s business, I would say that this valuation is more than reasonable, with plenty of upside to be had.

The bottom line

Infrastructure spending is expected to continue to be strong over the medium to long term. The growth drivers are there, from aging infrastructure to new industries and changing energy sources. In short, Aecon stock still has plenty of upside potential as it continues to capitalize on these trends. And as a bonus, Aecon stock is currently yielding 2.6%