The stock of MedReleaf Corp. (TSX:LEAF) has recently outperformed those of other top marijuana players in Canada, and there could be further price gains going forward after the recently listed cannabis firm has found its footing and stopped the earlier quarterly revenue declines.

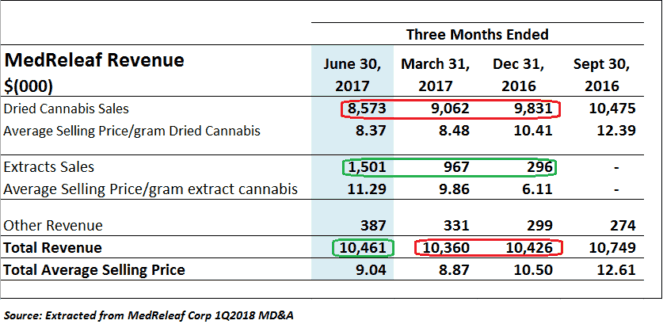

As previously discussed here, MedReleaf’s quarterly revenues suffered sequential declines since the quarter ended September 30, 2016; it picked at $10,475,000 before bottoming out at $10,360,000 during the quarter ended March 31, 2017.

The company battled the revenue-decline scare caused by a new Veteran Affairs Canada (VAC) policy introduced late last year, which limited reimbursement to $8.50 per gram and imposed a coverage limitation of three grams per day for the covered veterans effective May 21, 2017.

The great news is that MedReleaf has finally weathered this devastating storm and managed to marginally grow its top line by almost 100 basis points during the last reported quarter.

The following excerpt from the company’s first quarter 2018 (Q1 2018) report, ended June 30, 2017, shows how cannabis extracts (oils and capsules) have come to the rescue.

Evidently, it was the introduction of cannabis extracts, a higher premium product line, during the quarter ended December 31, 2016, that changed the company’s fortunes, even as dried cannabis product sales revenues have continued to decline sequentially since October 2016, as highlighted in red above.

Has the revenue decline bottomed?

Dried cannabis sales revenues have continued to slide lower over nine months, and the average price per gram has suffered due to a VAC-induced compassionate pricing policy, in which the company has been forced to offer price discounts to its loyal veteran clients to maintain the vital sales and relationships.

However, there is a great hope and a clear growth potential from new client acquisitions and, most importantly, accelerating cannabis oil and capsule sales. The revenue from cannabis oils and capsules has grown substantially over three quarters to offset quarterly declines in dried product revenues.

Cannabis oils contributed 14% to MedReleaf’s revenue last quarter and comprised of 23% of the company’s sales for June 2017, while the average contribution from cannabis oils has recently averaged 50% for the industry.

MedReleaf could see further exponential revenue growth from cannabis oil sales as the company moves towards this industry revenue structure in the next few quarters.

The increasing contribution of cannabis oil and capsule sales to the top line will not only produce further revenue growth, but they will also improve operating margins going forward.

It’s highly likely that we may see improved operating results in the next quarterly report.

Final thoughts

MedReleaf has finally won a critical battle against quarterly revenue declines, and the negative trend has recently reversed. The company is highly poised for future growth, even before the much-anticipated recreational marijuana sales kick off by July 2018.

The company’s sequential revenue declines over a solid six months where a nagging issue, worsened by management’s prior reluctance, until recently, to invest in further productive capacity.

This somehow led to some investor negativity, especially considering that MedReleaf priced its initial public offering (IPO) at $9.50, when the market was not yet aware of the slowing revenue growth in the growth stock’s fundamentals anatomy, and the stock price suffered.

I am compelled to turn bullish on this speculative stock, and not just for the revenue-growth issue discussed here.

The company has some of the lowest production costs in the industry, commands a significant market share in Canada, and is embarking on international expansion programs while expanding its productive capacity.

MedReleaf’s fundamentals could easily improve faster than those of its competitors.

Happy investing, Fools.