Shopify Inc. (TSX:SHOP)(NYSE:SHOP) stock has come a long way. In its early days, it faced many skeptics. Today, it is widely viewed as the biggest business success story of the times. This truth is reflected in Shopify stock’s performance.

Today, Shopify reported 2020 results. As expected, the results showed strong growth. But Shopify stock was down as much as 6% earlier today. The reason for this can partly be found in the company’s 2021 outlook.

Image source: Getty Images

Shopify stock: 2021 outlook has put a damper on it

2020 was an exceptional year. Revenue growth soared. In fact, revenue increased almost 90% in 2020. Operating income soared. And the number of entrepreneurs turning to Shopify accelerated rapidly. But in analyzing this result, we must take the macro environment into account. The reasons for this booming acceleration of Shopify’s business was not only due to Shopify’s excellence. Some of it was due to the macro environment.

Let me explain. It was a world where lockdowns are forced upon us. It was a world where many of us were nervous to head outside. Our traditional way of shopping was not an option. So, forced into a corner, we migrated online. Online shopping, or e-commerce, is certainly a good option to complement in-store shopping. But just as travel was artificially stunted in 2020, e-commerce was artificially uplifted. Shopify stock reaped the rewards.

Some of this migration and change of habit will stick. But the extent of it will slow down. It makes sense. So Shopify management is sending out directional sales guidance to prepare us. The growth of 2020 will not be the growth of 2021. It’ll slow. The vaccine is being rolled out. The virus will hopefully fade into the background. And this will mean at least a partial return to bricks and mortar shopping.

Shopify prepares for slower growth in 2021

2021 will see slower growth in 2021. This return to “normal” will make this happen. As investors, we must be prepared for this. Shopify stock may take a hit. But along with this, we must also be prepared for increased investment into the business. Shopify is in it for the long haul. While that’s a good thing, in the short-term, we may not always like the numbers. Again, Shopify stock may take a hit.

In 2021, Shopify will invest in areas of the business that will set them up stronger. For example, investments into Shopify fulfillment will optimize its distribution network and enhance the overall merchant experience. Also, investments in Shop App will reduce friction for buyers at all points. This will create value for merchants and buyers.

These and other focused investments in the business will further improve Shopify’s value proposition. But in the meantime, expenses will rise, putting pressure on earnings. Short-term pain for long-term gain.

Can we still justify Shopify stock’s valuation?

So the slower growth is really not the end of the world for Shopify. It has already grown three years-worth in 2020. Shopify is in it for the long haul. But what about Shopify stock’s valuation? Can it be supported now that growth will slow?

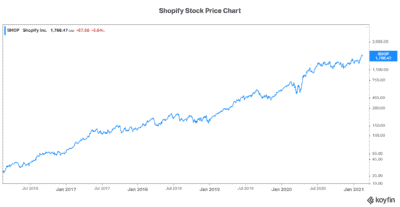

Look at this perfect stock chart. Shopify stock is trading at over 70 times sales. It’s trading at almost 1,000 times current earnings. And it’s trading at almost 90 times expected 2024 earnings. On the one hand, this is a growth company so these valuations can be expected. On the other hand, Shopify stock will have far to fall if growth expectations that are priced into it don’t materialize. Today may be the beginning of the fall.

The bottom line

Shopify stock had a blow-out year in 2020. General macro forces worked in its favour. Its business, culture, and know-how was able to shine through. It was the perfect storm. But beware, slower growth in 2021 may take the air out of Shopify stock in the near term.