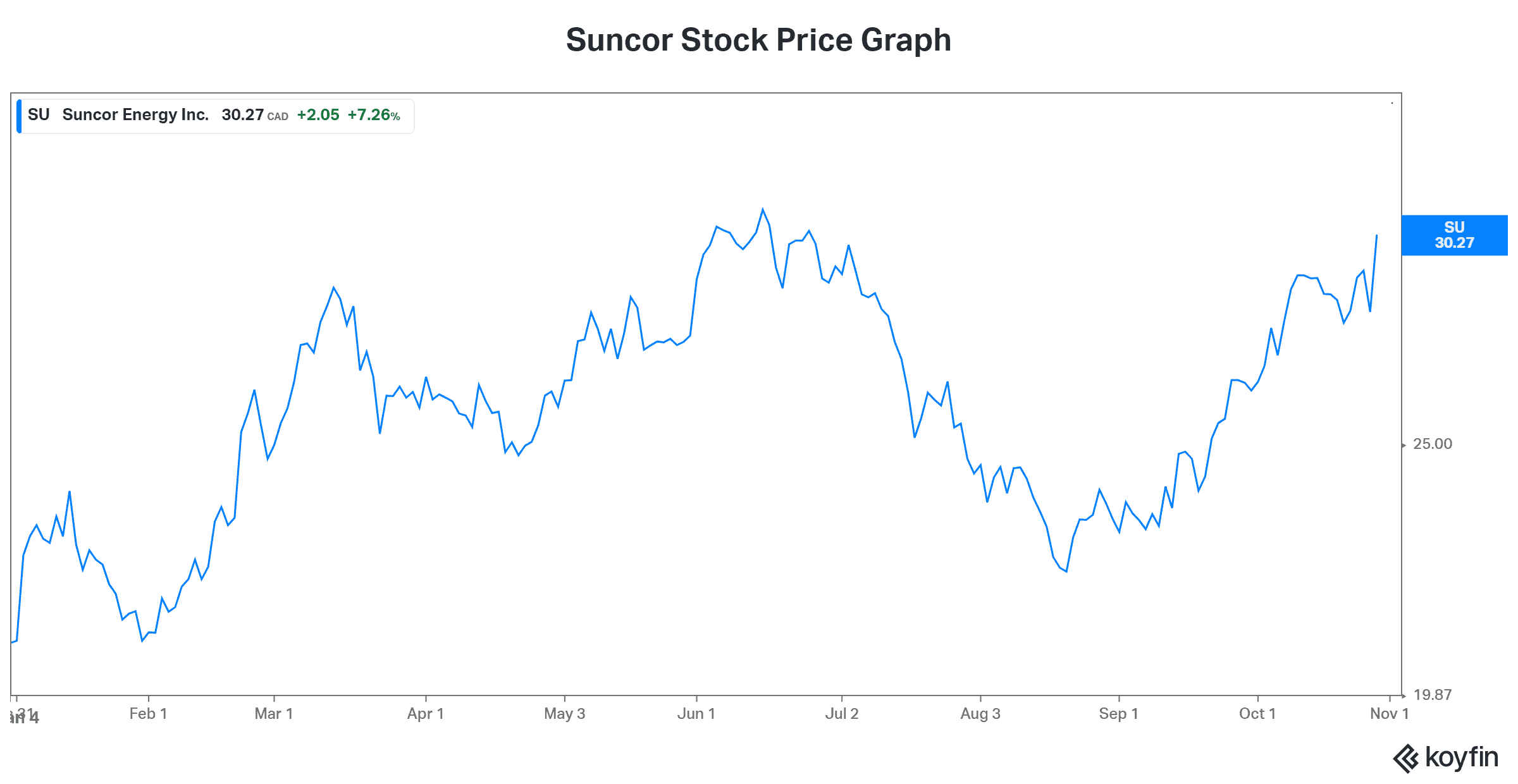

The Suncor Energy (TSX:SU)(NYSE:SU) stock price is on a tear: up 7% today and 40% year to date. With rapidly rising oil and gas prices, this makes sense. Suncor’s third-quarter earnings release demonstrates the bounty that is currently available in the oil and gas industry. It’s like the old days have returned, namely, when Canadian oil and gas was a booming business and energy stock investors got rich.

Here are the highlights of Suncor’s results that illustrate why this stock is rallying so strong and why it’s a keeper. The oil and gas cyclical upswing has only begun. Suncor stock is a smart, safe bet for exposure to it.

Suncor raises its dividend by 100%

Financial results at Suncor are booming, as evidenced by its earnings and cash flow growth. For example, Suncor’s net earnings swung to almost $1 billion, compared to a small loss in the prior quarter. Also, funds from operations topped $2.5 billion as higher oil and gas prices turn the fortunes of Suncor around.

So with these spectacular results, Suncor has accelerated its plan to return capital to shareholders. The dividend was doubled and the share repurchase program was increased. All of this is resulting in an ever-increasing shareholder return profile for Suncor.

Energy stocks like Suncor are stable income generators

With these results, I think that we can see the income and cash flow power of Suncor. In fact, I think we have seen it for many years now. I mean, even when oil and gas prices were weaker, Suncor still made a tidy profit. It was only in the darkest days of the pandemic that dividends were cut and losses began.

So what we have, at the end of the day, is a stock that has pretty consistently provided solid shareholder returns. In the decade, Suncor’s dividend has grown at a compound annual growth rate (CAGR) of 14%. It has generated tons of dividend income for shareholders as well as being consistent, reliable, and growing.

Suncor’s ESG moves create long-term value and sustainability

Finally, this quarter was another reminder of what Suncor is doing aside from the pure financials. For example, the company is forming good relationships with Indigenous communities. The Astisiy Partnership includes Suncor and eight Indigenous communities that give them a 15% equity interest in the Northern Courier Pipeline. This is a 90-kilometre pipeline that connects the Fort Hills oil sands mine to a Suncor terminal in Alberta.

Also, Suncor is continuing its move toward net-zero emissions. Suncor’s stated greenhouse gas emissions goal is to “..harness technology and innovation to reduce our emission intensity by 30% by 2030.” By 2050, the goal is net-zero. This will be achieved with carbon capture and sequestration. It will also require big investments in technology to change the way oil and gas are extracted and processed. Suncor has the expertise and the money to see this through.

The bottom line

It’s clear to me that oil and gas will be required to power our lives for many years to come. Suncor’s third-quarter results demonstrate this demand. It also demonstrates what a responsible oil and gas company like Suncor can deliver to its shareholders. In short, Suncor’s stock price is soaring today for good reason. Suncor stock is, in fact, a keeper.