Do-it-yourself (DIY) investing in stocks is a great hobby for any Canadian. However, you need to be curious, willing to learn, and enjoy taking some risks. Every investment is a risk. However, building a diversified portfolio of Canadian stocks is a great way to hedge those risks.

A long-term price to pay by investing with a professional

Certainly, investing with an investment advisor can be easy and take the strain/worry from investing. Sometimes it is nice to walk through the investing process with a professional. There is absolutely nothing wrong with that.

However, there is a high price to pay. Investment advisors are often incentivized to sell financial products and/or mutual funds. Often, these are high-fee, high-commission products that can significantly eat away at returns, especially over the long term. Not to mention, there is often a fee you directly pay your advisor, which can further eat into your returns.

Go for indexes/ETFs over mutual funds

Not all advisors work like this, but many do. If you are lucky, you might find an advisor who puts you into low-cost index funds or exchange-traded funds (ETFs) that generally mimic the market. It is challenging to beat the stock market, so this is certainly a respectable approach. However, you hardly need an investment advisor to guide you through that process either.

Build a DIY portfolio of investments in a way that works for you

Many people enjoying building their own DIY investment portfolios. Some combine indexes with stocks. Some people just buy stocks. The reality is, do what is comfortable and what works for you.

No matter what, investing is never easy. However, it can be a lot of fun and a great way to build significant wealth. If you are up to the challenge of DIY investing, here are two great Canadian stocks that would be great foundations for any investment portfolio.

A top Canadian dividend stock

Every Canadian should have some exposure to dividend stocks. When the markets are volatile (like they are today), dividend income can be a great way to collect stable cash returns. One top stock every Canadian should own is Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP).

Infrastructure is a great asset class because it provides essential, reliable streams of cash flows. BIP is one of the largest diversified infrastructure businesses in the world.

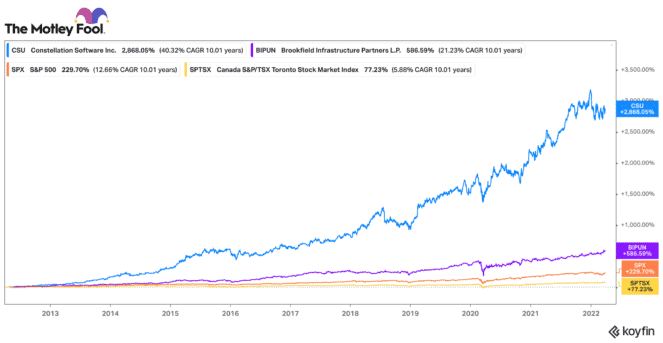

For the past 10 years, it has compounded EBITDA and adjusted funds from operation per share annually by 13.7% and 10%, respectively. Likewise, it has grown its dividend by around 10% annually over that time.

Given its exposure to energy, inflation-indexed contracts and multiple new acquisitions, this Canadian stock actually benefits from inflation. Today, it pays a 3.4% dividend. For income, growth, and safety, this is a great stock to buy and hold for years to come.

A top Canadian growth stock

Stocks that compound returns are important in a portfolio. They are stocks you buy, hold, and let the company do the work and returns for you. Constellation Software (TSX:CSU) is a stock you buy and plan to hold for 10 or 20 years ahead. It has delivered a 2,850% return over the past 10 years. It has one of the best and most consistent track records of returns on the TSX.

Constellation has grown by consolidating niche vertical software market businesses all over the world. It invests at very high rates of return and then re-invests the proceeds into new investments.

Last year alone, it put $1.3 billion of capital work (its largest investment ever). This should translate into strong cash flow growth in the years to come. This Canadian top stock is down 7% this year and at a reasonable valuation. Historically, any major dip in Constellation stock has been a great buying opportunity, and that’s what looks to be the case today.