It has become increasingly clear that in order to invest successfully, we need a winning strategy. If we weren’t already convinced, 2022 has certainly taught us that. So, with this in mind, we can look to investing greats like Warren Buffett — an investor who’s made a career out of disciplined, thoughtful investing.

Warren Buffett stocks

Warren Buffett is famous for saying a lot of insightful things. One of them is to “be greedy when others are fearful and be fearful when others are greedy”. This is a good starting point. The idea behind this mantra is that when people are greedy, the market (stocks) are likely overvalued. On the contrary, when people are fearful, stocks are likely undervalued. Right now, investors are understandably fearful.

This way of thinking teaches us to go against the herd. It teaches us to hopefully take advantage of mispricings that happen due to market psychology. With this is mind, there are other things that Warren Buffett looks for — for example, a business with a competitive advantage; strong cash flows and predictability; and staying power and the ability to generate attractive returns.

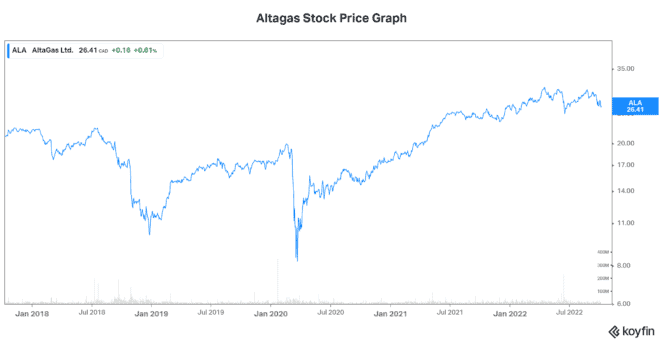

AltaGas: Profiting from the energy boom

The first stock that I think fits the Warren Buffett stock bill is AltaGas (TSX:ALA). AltaGas is a $7.4 billion North American energy infrastructure company. Its EBITDA (earnings before interest, taxes, depreciation, and amortization) is derived from two segments: the utilities and midstream segments.

The utilities segment accounts for roughly half of AltaGas’s EBITDA. This is AltaGas’s defensive segment. Utilities are inherently defensive, as they provide us with the essentials. The functioning of society as we know it is reliant on the energy that brings it to life. It’s needed with everything we do. AltaGas has utilities assets that serve 1.7 million people in the United States. This is a regulated business, which means that pricing is fixed.

AltaGas’s other segment is the midstream segment. This segment focuses on oil and gas infrastructure. Its claim to fame is its global export infrastructure. This infrastructure is making the global export of Canadian natural gas possible. It’s also relatively stable, as the contracts are long term in nature.

AltaGas trades at a price to book of only 1.2 times. It also has a growing earnings profile, with strong growth expected from its liquefied natural gas export terminals.

Fortis: The ultimate of utilities stocks

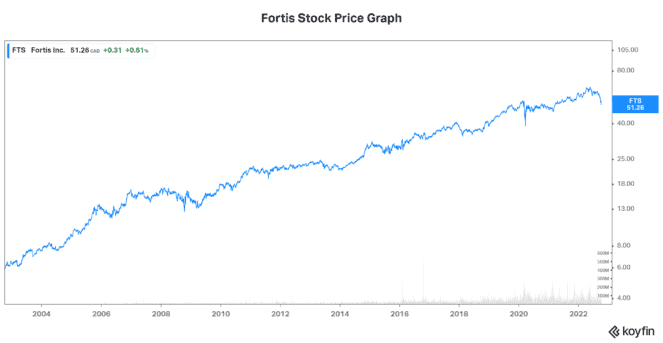

The second stock that qualifies as a Warren Buffett stock is Fortis (TSX:FTS). Fortis is a leading North American regulated gas and electric utility company. There’s a lot to point to that highlights this stock’s value. For example, Fortis has consistently raised its dividend for 49 consecutive years. This speaks to the quality and predictability of its earnings and cash flows.

Also, Fortis has been creating shareholder value throughout different economic cycles and over many years. This is due to the fact that its earnings are exceptionally stable — as is its business. As a result, Fortis has seen its stock price rise dramatically over the long run. Take a look at its stock price graph below.

So, Fortis stock has fallen 16% in 2022. This is a lot of volatility for a stock like Fortis. It reflects the difficult environment that we’re faced with. It also reflects the fact that rising interest rates can be detrimental to companies that have a lot of debt — like Fortis, and all utilities, for that matter. But it does not reflect anything negative about Fortis’s investment merits.

Looking back at its stock price graph, we can see that this is a resilient stock that remains reliable even in bad times. Its dividend yield is currently 4.45%. And it’s become a very attractive opportunity at a time when investors’ fear is driving down all stocks.